How can a 21st-century business contribute to a future of prosperity for all? In her new book, “Doughnut Economics,” self-described “renegade” economist Kate Raworth denounces economics as we know it and calls for a holistic view of the market as it is embedded within earth and society.

In this accessible book, Raworth shares wisdom gathered over 20 years of entrepreneurship and human development work to urge today’s businesses and financiers to stop obsessing over growth and consider how to give back to and sustain our communities and the environment. We spoke with Raworth to learn more about her perspective.

When I talk to conscious business advocates, the topic of “leveling the playing field” often comes up: the idea being that conscious businesses are at a price disadvantage because they refuse to take shortcuts that negatively impact the environment and society. I see many parallels between this idea and the “embedded economy” you discuss in “Doughnut Economics.” Could you elaborate on what you mean by the embedded economy, and talk about how we can encourage more businesses to consider themselves as part of this bigger picture?

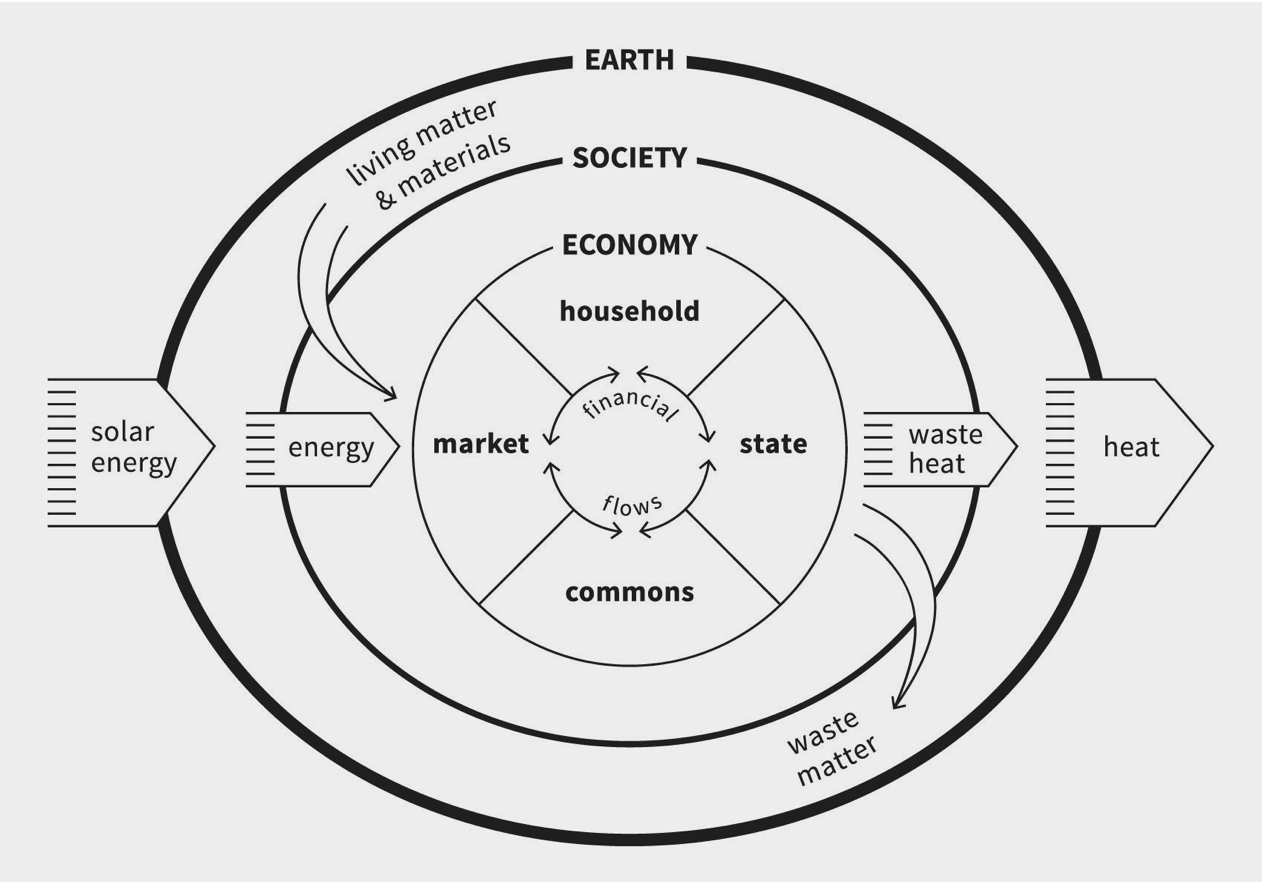

Kate Raworth: Twentieth-century economic thinking encouraged us to see the market as a self-contained system. This meant the economy simply drew in the labor and the resources it needed and optimized their use to make a profit. It’s a very narrow conception of what the economy is. I have redrawn this system, and I call it the “embedded economy.”

This recognizes the four means of provisioning: the market, the state, the household, and the commons. If you think about an enterprise, which is traditionally situated within the market, you can see it actually depends upon all of these four means. It depends upon the state to provide the public infrastructure on which its access to others is based, as well as the legal and trust infrastructure that makes it work smoothly. It depends upon the household to get workers ready every day and prepare the next generation of employees. And it depends upon the commons, which contributes almost invisibly so many valuable goods and services to the economy. So already we can see that enterprises are embedded within a much richer context of economic provisioning.

The embedded economy, which ties the financial flows to the society and environment on which it depends. Concept by Kate Raworth. Design by Marcia Mihotich .

Conscious businesses already recognize that they are embedded within this much wider system of provisioning. If you look to the natural world, plants, too, respect and contribute to those around them. Biomimicry expert Janine Benyus says giant redwoods comb huge amounts of water out of the air at night. But they don’t take that water only for themselves: Redwoods actually water all of the plants around them. They are embedded within the forest, and that they wouldn’t survive as single standing trees. There are really great opportunities for conscious companies to think of themselves like that: as a nurturing member of the economy and society in which they’re based.

Taking a narrow cost focus can actually end up boomeranging against you. We’ve seen so many examples of companies that are exposed because of the exploitation of their employees or their extraordinary degradation of the living world. This has narrow cost and brand implications for them.

I’ve also worked with many companies that already realize they need to take a broader stance toward how they relate to the world because their own supply chains are deeply dependent upon the living world for the fundamental resources they use to make their products – whether they buy clothing made from cotton grown across the world or produce beer in Africa or Asia while relying on the local water table. If they neglect that and take a narrow cost focus, they actually make their own supply chains far more vulnerable.

I’ve been impressed by some formerly mainstream companies that are beginning to realize that they need to take a more conscious approach. Companies that begin to take these values into account now and base their business models on multiple value sources will embed themselves in a far smarter way.

Sometimes it can feel like businesses are satisfied with depleting natural resources in their local communities and then simply moving on to the next area in order to keep costs down. It’s refreshing to hear your optimism in this regard.

KR: I think we’re at a moment, particularly with Donald Trump as the American president, where we’re seeing many attempts to undercut environmental protections. If any good can come out of this extraordinary political moment, it’s that ordinary people are shocked. They realize that what gets presented as “regulation” and “red tape” are actually protections for our health and protections for the living world on which we depend. We don’t want to see those protections ripped away simply to allow businesses to be more extractive.

In a way, when extreme political measures are proposed, it helps us see more clearly the extremity of what’s at stake. Yes, it is easy to lose optimism in moments when things seem to be going in the wrong direction. I believe that makes it all the more important to speak from a powerfully clear voice of an optimistic vision of the world we want to create. Otherwise, we end up sliding into a world we don’t want to be in.

One of the most interesting takeaways I found in “Doughnut Economics” was your call for “generous business.” You argue that businesses should not only aim for net-zero impact, but also strive for regenerative design.

Today when we talk about mitigating the effects of global warming and environmental degradation, we mostly talk about neutralizing our environmental impact, but not so much about creating a net positive impact through regenerative design. How do you envision a world driven by regenerative design, and how do you think the dialogue could be moved in this direction?

KR: As the designers William McDonough and Michael Braungart say, being less bad is not being good. It is being bad, just less so. And even if you can achieve “mission zero,” why would you stop at the point of doing no harm when you’re on the threshold of doing something far more transformative?

If you can do no harm, is it not possible that you could actually do good? Is it not possible that you could actually be generous?

You could have a building that not only generates its own electricity, but creates more electricity than it uses. You could create a factory that puts cleaner water back out into the river. You could have a building that sucks out dirty city air, cleans it and puts it back out into the city cleaner than it came in. This is when humanity starts to behave like a giant redwood and actually creates benefits that it then shares amongst the community.

As Janine Benyus put it, “The 20th-century business question is: ‘How much value can we extract from this?’ We need to transform that mindset and ask ourselves: ‘How many benefits can we layer into this so we can give some away?’”

While many designers are already thinking in a 21st-century way of being generous, they so often run into 20th-century economics that still ask, “How much value can I extract from this?” There’s a clash of culture. We need to transform this mindset into one of 21st-century finance that’s in service of the living world, which is:

“How can we finance this regenerative design so that it gives a fair return for our investors and gives away generous value, whether it’s social, natural or cultural?”

That old 20th-century mindset is blocking our potential for far more regenerative cities, companies, product, and communities. I think there will be a showdown at some point between regenerative design and extractive finance, and regenerative design has to win.

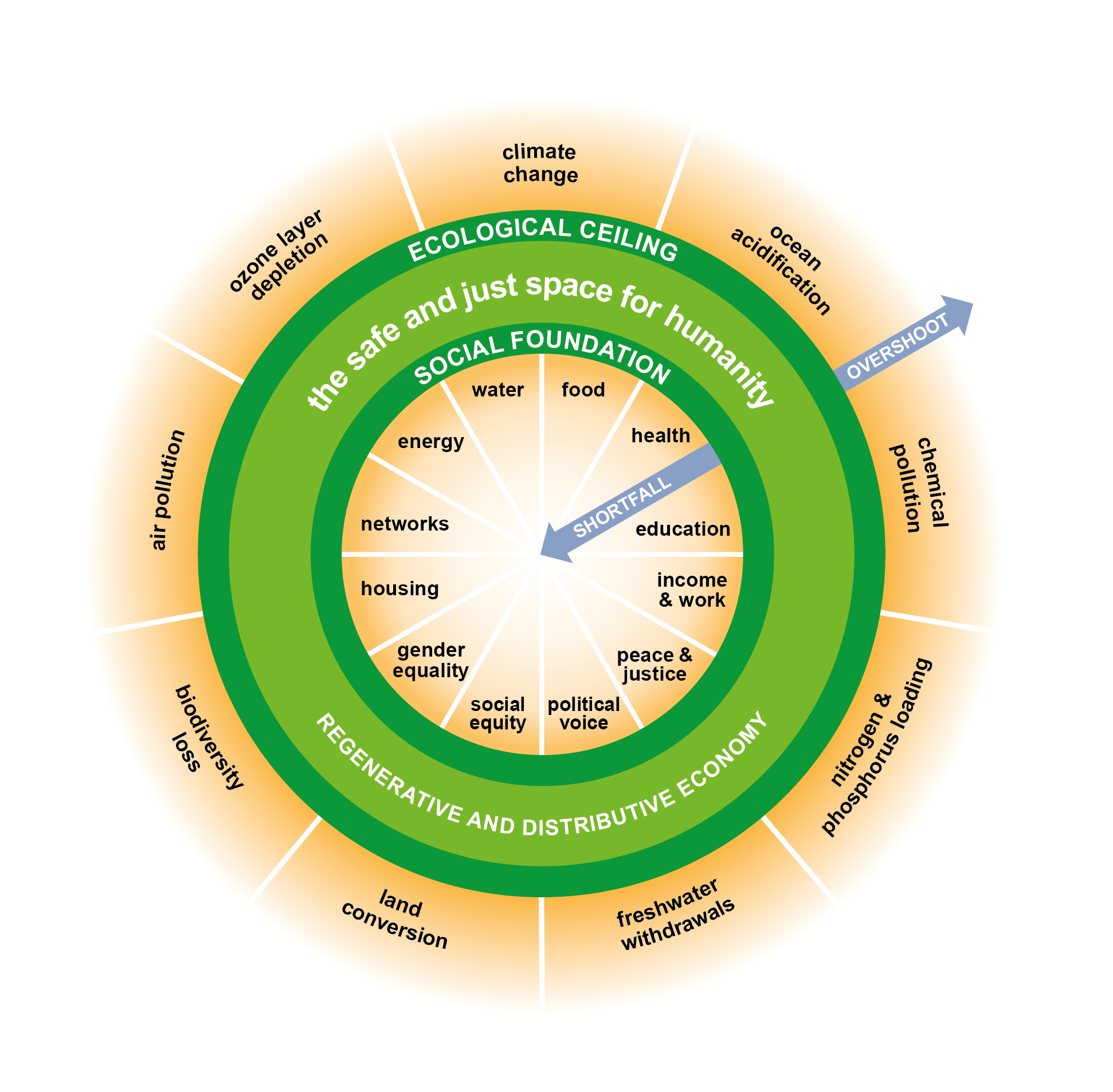

I’ve created the doughnut diagram that shows a compass for humanity to meet the needs of all within the means of the planet, and I’ve presented it to many companies, including the Fortune 500s. It poses an important question: What kind of business are you going to be? Are you going to be the kind of business whose core practices undermine people’s rights and degrade the living planet, or are you going to transform into a business whose core practices actually help bring humanity into a space where everyone can meet their needs within the means of the planet? Some of them find it very affirming, because it depicts an optimistic picture of the world in which their business can contribute to a thriving future.

Can you offer an example in which this extractive mindset has improved or changed?

KR: Well, there are certainly new financial institutions that have come through with these values, for example ethical banks that actually borrow people’s money and invest it in regenerative projects. They give you a fair return, but also inform you about the social, environmental, and cultural value that’s being created in this project. Anyone who’s thinking long-term about the world we are creating for our children and grandchildren should be thinking about how their pension or their savings is being invested not only to generate a fair return for themselves, but also to be generous to the future.

We also have the rise of B Corporations, which embed living purpose at the heart of their business mission. They do not aim only to provide maximum financial return to shareholders, but also to provide a fair return to investors along with social, environmental and community value.

Toward the end of “Doughnut Economics,” you talk about the importance of being “agnostic about growth.” Why is growth for growth’s sake unsustainable? What can we do, as citizens and as businesses owners, to align our efforts with sustainability?

KR: Western economies in particular have evolved to be socially, politically and financially addicted to growth. Everything in nature grows, but nothing grows forever. It comes to a maturity, and then it can thrive for a long time. Our feet grow until we are 18, and they can thrive until we are 80, 90, or 100.

But something that attempts to grow forever can destroy itself or the system on which it depends.

Cancer is the obvious example we know from our bodies, where something is attempting to grow forever and through that process destroys the system it relies on, and ultimately destroys itself. So it’s strange that we have this lust for endless economic growth without wondering whether it could ultimately be disruptive of society and the living world. We now need ingenious financial innovation to find ways we can get a fair return from a product that isn’t continually growing but that has become mature and is thriving.

It looks like we’ve come full circle.

KR: Yeah, that does bring us full circle. The 20th-century industry mindset has been a very linear one where we take Earth’s materials, turn them into stuff we want, use them for a while, and then throw them away. What we need to do is become part of the cyclical processes of life.

Whether it’s the cycle of carbon, the cycle of water or the cycle of nutrients, we need to imagine ourselves in those cyclical processes so that we create, for example, circular economy enterprises that don’t use Earth’s materials up: They use them again and again.

Regenerative design is finding ways to be parts of the cycles of life and be part of the living world. What we now need is a business design and a financial design that catch up to the possibility that is waiting for us.

Anything else you’d like to add?

KR: From all the people I meet, those who work for companies driven by living purpose are the ones who smile about what they do. There can be no greater security and resilience for a company than having employees who love their jobs. I think beyond the immediate cost benefits that one sees in a company’s accounts, it’s the spirit of the workforce and those to whom the company contributes that makes a company resilient. It’s an incredibly important value to embed. The young people I teach are all craving to work for this kind of company. I think that’s a very strong attribute of a conscious company, and I hope that the concept of the doughnut helps to empower companies in pursuing it.

This interview was edited for clarity and length.

“Doughnut Economics” was released on April 6, 2017. Check Kate’s website for other speaking engagements.