A SOCAP Guest Post by Jayanth Kashyap

Emerging Cohort of Impact Investors

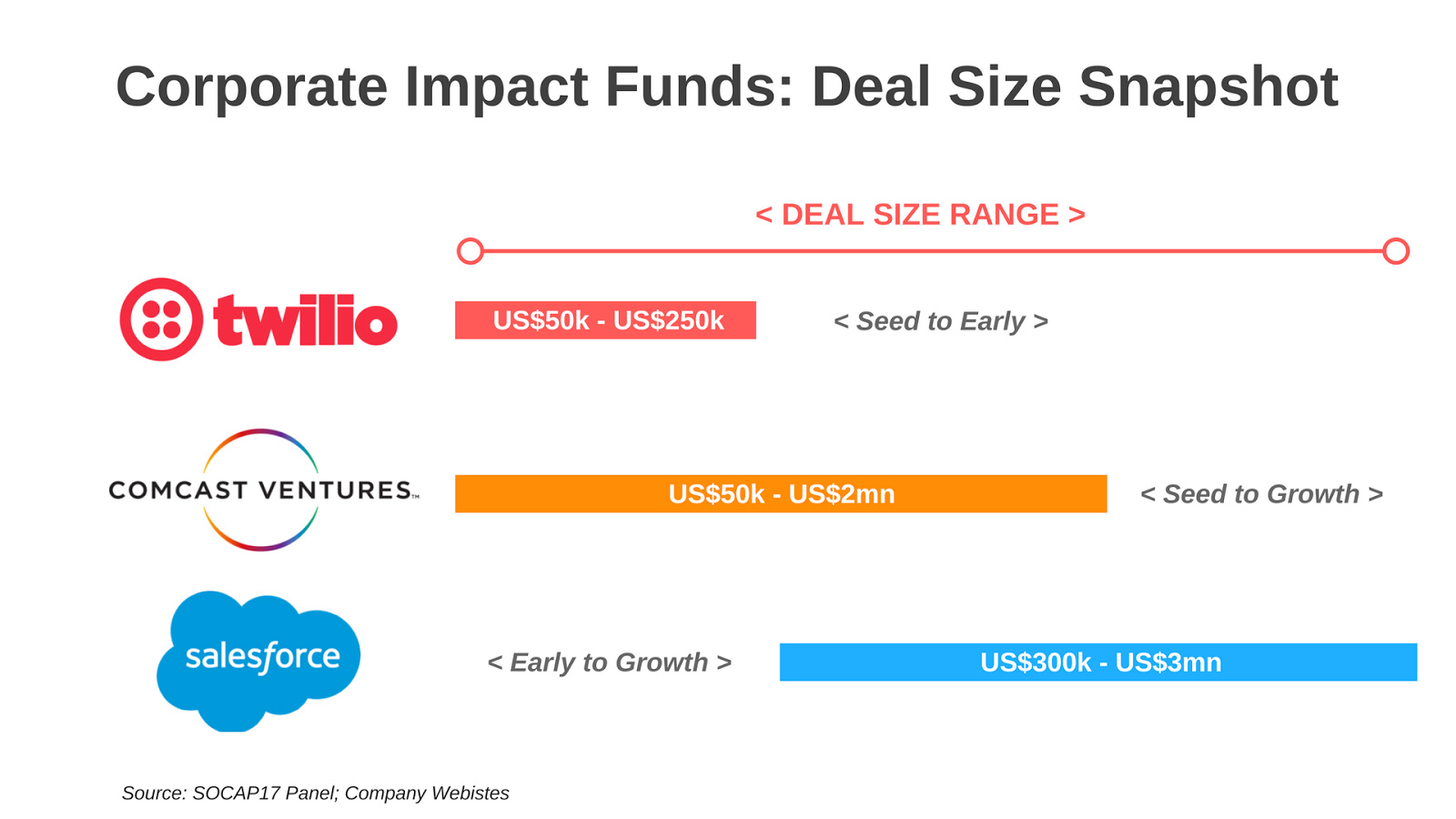

The concept of corporations investing in startups or non-profit organizations through venture capital and philanthropic models is not new. A recent CB Insights briefing on Corporate Venture Capital (VC) activity indicates that globally, corporate VCs participated in $13.3B of funding across 798 deals in the first half of 2017 alone. In 2016, corporates participated in US$25.6B of funding across 1422 deals. That is a staggering amount of capital being pumped into the startup ecosystem around the world, where the share of corporate VC deals is about 20% of all VC deals. Meanwhile in corporate philanthropy, about 2521 corporate foundations in the US gave US$5.1B in 2014, including grants to organizations and employee matching gifts. At SOCAP17, three major corporations (Salesforce, Twilio and Comcast Ventures) pointed towards growing interest and strategic alignment in entering the burgeoning impact investing segment.

So, why is this a critical timeframe for corporations to embrace impact investing? On Thursday afternoon of SOCAP17, panel moderator Robynn Steffen (Senior Manager, Omidyar Network) led an engaging conversation with panelists Erin Reilly (VP of Social Impact, Twilio), Kai Bond (Managing Director, Comcast Ventures) and Suzanne DiBianca (EVP Corporate Relations, Salesforce) diving into the emerging cohort of corporate impact investors.

Motivations for Corporate Impact Investing

“If we brought intentionality, could we find companies that fit our strategic initiatives?” remarked Suzanne DiBianca on the genesis of the newly launched US$50M Salesforce Impact Fund – part of Salesforce Ventures – seeking to accelerate the growth of companies using Salesforce technology to address challenges across workforce development, equality, sustainability and the social sector. This intentionality, according to Suzanne, is a key aspect of the fund’s mandate which invested in four social enterprises earlier this month.

Twilio, a cloud communications company, also launched the Twilio Impact Fund (Donor-advised) earlier this year to support innovative communications technologies. Erin Reilly commented that the Impact Fund is supported as part of Twilio’s participation in the Pledge 1% initiative. Through this initiative, Twilio pledged 1% of company equity to fund Twilio.org for a period of 10 years. Interestingly, the Pledge 1% network is a global initiative spearheaded by Salesforce, Atlassian, Rally and Tides to encourage corporates to pledge either 1% of their equity, time, product or profit to give back to society.

Comcast Ventures, through its Catalyst Fund (founded in 2011) seeks to support technology companies founded by underrepresented ethnic minority entrepreneurs in the consumer, mobile and enterprise sectors. Kai Bond shared that there is enormous untapped value in minority entrepreneur led startups, which are typically underfunded (for instance, only 1% of startup founders are Black in the US) and that the Catalyst Fund is one of the few VC funds with such an inclusive investment mandate.

Challenges, Opportunities and Market Maturity

There is generally low awareness about impact investing according to the panelists, as well as a big gap in knowledge about using corporate dollars for funding for-profit enterprises. “I have worked in corporate grantmaking for the past 15 years, but impact venture capital is completely new for us” commented Erin Reilly. Understandably, corporations that have supported causes through traditional donations and grants may find entering this segment to be daunting. But the entry barriers are not exceedingly difficult says Erin, who emphasized that partnering with experienced impact investing veterans such as Omidyar Network, Kapor Capital, Village Capital and foundations such as Bill & Melinda Gates Foundation and Draper Richards Kaplan Foundation was greatly beneficial.

For social enterprises, having a strategic partner or investor can unlock tremendous value in its operations as it scales towards sustainability and profitability. When questioned on how these impact funds are different to traditional VC funds, the panelists shared that investments are only made in companies where there is a strong strategic alignment with the corporation – in terms of technology and market or customer base. Twilio and Salesforce for instance share the technical expertise of the broader corporations with their investees. Additionally, the investees also receive access to the customer base of the corporations – in the case of Salesforce which has almost 150,000 customers, this advantage could be a powerful enabler for the social enterprises to market and expand the scope of their products or services to a global audience.

The panelists stressed that there is a need for corporates to enter this space as foundations have reduced their grantmaking toward technology and innovation. It is important to acknowledge that these corporate impact funds are entering the early days of the social venture, from the seed to Series-A rounds where the failure rates are high.

The convergence of corporate philanthropy and impact investing could potentially improve the availability of smart capital available to entrepreneurs and the investees could be targets for acquisitions by the corporations in the longer term – providing much needed exit routes for other impact investors. A 2016 New York Times article indicates that over US$1.9T of liquid assets exist on corporate balance sheets. In contrast, the global corporate impact investing industry is estimated at US$2.4B by a CECP study, whereas the overall impact investing industry size is about US$60B and projected to grow to US$2.5T by 2025. Clearly, corporate impact capital can play a crucial role in filling the typical ‘valleys of death’ faced by social ventures struggling to raise funds.

The convergence of corporate philanthropy and impact investing could potentially improve the availability of smart capital available to entrepreneurs and the investees could be targets for acquisitions by the corporations in the longer term – providing much needed exit routes for other impact investors. A 2016 New York Times article indicates that over US$1.9T of liquid assets exist on corporate balance sheets. In contrast, the global corporate impact investing industry is estimated at US$2.4B by a CECP study, whereas the overall impact investing industry size is about US$60B and projected to grow to US$2.5T by 2025. Clearly, corporate impact capital can play a crucial role in filling the typical ‘valleys of death’ faced by social ventures struggling to raise funds.

Path Forward

The panelists agreed on the importance of finding other impact investors aligned to the values and stage of investing (Omidyar Network is also a co-investing partner to Salesforce Impact Fund). This syndication leads to several synergies for the corporate investor and the impact investor – shared deal flow, shared expertise, access to markets and deeper pockets of capital. For potential investees, the panelists urged that entrepreneurs should have a clear vision of how corporate assets could be leveraged to advance their social objectives. Towards the end of the session, there was a clear call to action for corporations to engage in the impact investing segment – either through direct investments, self-managed funds, donor-advised funds or other mechanisms which suit the regulatory environment of the markets the corporates operate in. Comcast Ventures is looking to invest in 100 minority-led companies, whereas Salesforce is seeking to deploy its capital in the next two years and double the size of its fund to prove its business case. Salesforce is also looking to improve the diversity of the founders of its investees. Twilio is committed to its social mission and wishes to see more corporates take the equity pledge towards impact investing.

Jayanth Kashyap B is an impact investing professional and recently graduated from the MBA at Saïd Business School (University of Oxford), where he was also a Director at the Oxford Seed Fund – a student-led technology VC.

Jayanth Kashyap B is an impact investing professional and recently graduated from the MBA at Saïd Business School (University of Oxford), where he was also a Director at the Oxford Seed Fund – a student-led technology VC.

Prior to the MBA, he was part of an India-focused seed impact fund at Ennovent and led the firm’s impact investment advisory projects across emerging markets. He is currently based out of London, UK and is active on LinkedIn, Twitter and Medium.