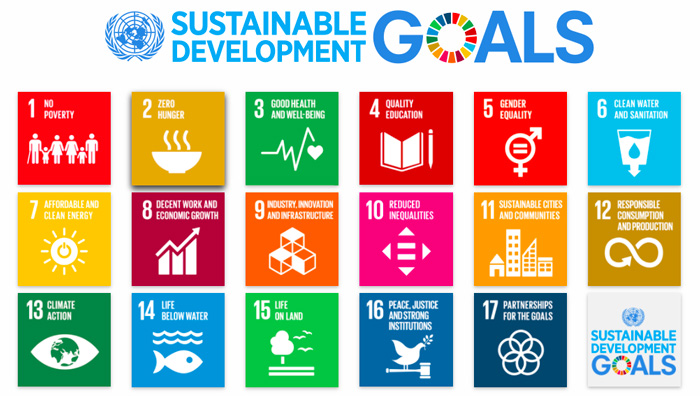

When Achim Steiner began his address at SOCAP17, he introduced himself as the son of farmers, a boy raised on a farm in Brazil who grew up to become the Administrator of the United Nations Development Programme (UNDP). In this role, Steiner heads an organization that works in 170 countries and territories with a mission to achieve the eradication of poverty, and the reduction of inequalities and exclusion. He also serves as chair of the United Nations Development Group, an organization that unites the 32 UN funds, programmes, specialized agencies and other organizations that are working together to achieve the Sustainable Development Goals (SDGs).

Known worldwide as a passionate advocate for the SDGs, Steiner drew upon his personal knowledge of the local and the global challenges we face in his mainstage address at SOCAP17 to explain the true purpose, vision, and importance of the SDGs and to describe the ways they serve as a framework for investment in a better future for our planet and for all of humanity.

This video of Steiner’s remarks from SOCAP17 is accompanied by a full transcription and a follow up conversation he had with ImpactAlpha Editor David Bank.

The SDGs are not “the answer,” but a “framework” and a “declaration of interdependence”

“Many or most of you will have heard of the Sustainable Development Goals. You may know of its genesis and the link to finance and impact investing. But let me also say (and some of you will be familiar with Douglas Adams Hitchhiker’s Guide to the Galaxy–the answer to the question about life, the universe, and everything was so simple: 42) I want to emphasize the SDGs are not attempting to be the answer.

The Sustainable Development Goals, as they have evolved and were then agreed upon by every nation on this planet, are first of all a common framework with which to recognize the challenges that lie before us. Secondly they are also a declaration of interdependence.

We know from our 20th Century history that economic development that ignores social dimensions, inequality, alienation, marginalization, sooner or later runs into crisis. Just like ignoring our planet (the environment, sustainability) can ultimately destroy economies and societies. So that linkage between the economic, the social, and environmental is central to an integrated approach. And it is a declaration of interdependence amongst us as peoples at the beginning of the 21st Century with seven billion people on this planet, soon eight, nine, and ten billion people. Decisions taken in a city like San Francisco can influence the lives of people literally thousands of miles away and vice versa.

“Life is complex at the beginning of the 21st Century”…The SDGs “accept complexity, but not let us be paralyzed by it.”

“Life is complex at the beginning of the 21st Century”…The SDGs “accept complexity, but not let us be paralyzed by it.”So this group of goals is not the answer, but it provides us with a framework with which to look, first of all, at a simple fact–life is complex at the beginning of the 21st Century. Let’s not pretend otherwise. But to argue that everything is connected to everything else and therefore nothing can be done is also very paralyzing. So the power I believe of the Sustainable Development Goals that we now see unfolding across the world is that it tries to accept complexity but not let us be paralyzed by it.

“How we can achieve win-win outcomes rather than trade-offs and win-lose outcomes, whether across the social, the economic, the environmental…”

It provides us with a common framework with a common language. It also gives us a way in which to understand how we can achieve win-win outcomes rather than trade-offs and win-lose outcomes, whether across the social, the economic, the environmental, or indeed between poorer nations or richer nations.

The opportunity it speaks to, and why I am here with you this morning is that financing is critical. It is central and it is also recognition that governments and we in the United Nations system have had to come to terms with that. Public finance, governments as investors, are just a small share of our economies. To try to address the great challenges of the 21st Century that we need to address together collectively, requires us to bring the three quarters of four-fifths of economic activity in alignment with these objectives.

The SDGs are an expression of a common and shared strategy and remarkably it is not only resonating with governments across the world and whether they are developing or developed countries industrialized or poor island nations, but what I have been most astonished about is how people in the private sector world (and) in the investment world are beginning to look at these Sustainable Development Goals as a real opportunity.

We have extraordinary human ingenuity at our disposal. Never in the history of humanity having lived in such extraordinarily powerful times in terms of possibility. Science, technology, knowledge, education just to mention a few, are at our disposal as never before. Wealth and money has reached unprecedented levels in terms of the wealth that is at our disposal but the extraordinary thing is that we live in a world where many people are looking to invest their money and can’t find the right place to do it in and yet much of the world is actually looking for money to invest in solving problems. Problems for ourselves but also for the common good of humanity. I know that this is part of the reason why you are here together.

How can we invest in one another’s common future?

Let me speak for a moment to this idea of why a United Nations family and the family of impact investors should be talking to one another.

We work at the frontline of understanding the risks to the future of humanity. We intervene, unfortunately, very often as a crisis response as you very often can watch on television sets when health crises break out, conflicts, natural disasters, civil wars. But under the leadership of our new Secretary General, prevention has taken a far greater place in the work of the UN and in terms of how we would like to work. The SDGs are our opportunity to start investing together in different futures and that requires us to come together.

What we need, however, for that to happen is to have good public policy. This is one of the core tasks of the United Nations family, whether across health, international aviation, the universal postal system, whether it is in the International Labour Organization or indeed in the World Trade Organization. The extraordinary thing about the United Nations family of specialized agencies is that they cover virtually every aspect of what allows us to trade with one another, communicate with one another, invest in one another. And that is part of the proposition of these Sustainable Development Goals. How can we invest in one another’s common future?

You represent a part of the world that has the means and the resources to actually bring the finance to the kinds of agendas that we know we cannot address in isolation from one another.

Let me just give you a couple of examples to illustrate that this is not just abstract thinking. It is not just prose and rhetoric–it is in fact a very real investment proposition.

Public policy often is viewed as big government and more government, but let us also be frank that discussion of the 80s and 90s that the less government the better, the more market the better, is too simplistic an answer. Public policy is in the first instance an expression of our common interest. It is how we would like to have our economies and societies function. And we make different choices in different communities and nations. But without public policy, without a regulatory environment, we know that there will be too many failures.

In the United Nations what we try to do is to bring the best of science and of political analysis and economic analysis and point out to leaders across the world where the greatest risks for the future lie. (For example) Health crises. You have seen just in the last few years how close we came to sometimes almost having to shut down our global economy because of the outbreak of infectious diseases. We spent the last 25 years trying to bring to the attention of the world the threat of carbon dioxide–something that most of us would have learned about in school and then forgotten about it. It is transforming everything on this planet and we have helped by bringing nations together every year in these painfully slow processes of agreeing on what to do to act collectively because climate change is another illustration that shows why one country acting to solve a problem has no chance of succeeding if others do not join.

“Extraordinary markets and opportunities have opened up”

On the back of that, and this is part of the DNA of the SDGs, extraordinary markets and opportunities have opened up. The renewable energy revolution that you know in the state of California has one of its homes, is however a part of this effort of bringing the global community of nations together to say we have to transition to a low-carbon economy.

Many of you are already investors in the sectors of energy, of transport, of cities, and urban infrastructure, or indeed of agriculture. And on the back of this common agenda that unites us and will hopefully allow us to look at global market spaces and places as acting in unison–unbelievable opportunities for investment are opening up.

“Much of our money is invested in maintaining a 20th Century economy rather than facing the challenges of the 21st century”

But our financial system is not aligned with addressing these. In fact much of our money is invested in maintaining a 20th Century economy rather than facing the challenges of the 21st century. Take for example an issue such as food waste. We know that we have to increase agricultural production or at least food production in the coming years significantly if you are going to feed another two to three billion people on this planet. And yet our agricultural production system today is already producing food in such a way that we are destroying land on which we grow food.

We have a net loss of arable land. Add to that the fact that more than 35 percent of all food produced every year on this planet is never consumed because it is lost between farm and market, or it is just thrown away. (Because of) sell by dates, the luxury of buying cheap food, it rots in the fridges, it gets thrown away in cafeterias and restaurants. The waste of food is unbelievable. Our opportunity is to work with you to look at ways in which we can address this–to turn problems into opportunities and address in the space for solutions in a way that we can scale up.

The UN can “bring pilot projects to demonstrate possible solutions” but cannot “take them to scale.”

In our work every day in the United Nations we can try to bring pilot projects to demonstrate possible solutions. We cannot and we are not in a position to take them to scale. Countries are not in a position to take them to scale. They need you, particularly as impact investors, to be the pioneers, the entrepreneurial leaders, the catalysts that can create confidence and trust in an economy that, rather than adding to our problems, begins to make investment a part of the solution.

My hope is that the Sustainable Development Goals, as you can use them in your everyday decision-making and thinking, will increasingly become a concept and a language that unites us.

Much of the economic paradigm of the last 50 to 100 years was premised that somehow our individual well-being is premised on out-competing the other. Now competition is good. Many of you in this room wouldn’t be sitting here if you hadn’t been a very good competitor in what you do. But as a human family at the beginning of the 21st century let us be honest we cannot simply premise our common future on out competing one another in a world with 10 billion people where pollution where the risk of disease, of economic collapse, of social upheaval because of inequality and poverty, threatens the very fabric of our global economy that we so often invoke is a real challenge.

“Help us awaken a financial system, a financial market, a universe of investors that (can)… bring meaning to money and bring money to meaningful solutions.”

My plea my invitation to you is to engage with us in the United Nations. We are part of that ecosystem in which you operate. We have a particular role that we can bring to this as we recognize increasingly that you have a unique role. Help us awaken a financial system a financial market, a universe of investors that accepts that you can, as you have so often discussed in SOCAP meetings, bring meaning to money and bring money to meaningful solutions.

“the 21st Century could be the greatest century in human history. It could also be the worst.”

Ladies and gentlemen, the 21st Century could be the greatest century in human history. It could also be the worst. Those were the words of Jim Martin, whose school I had the privilege to lead at the University of Oxford for the past year, a school focused on the great challenges of the 21st Century. Now one of the most manageable challenges that we have, is to actually bring all that money, all that wealth, of all that capital that is looking for good and valuable and also profitable things to do in alignment where humanity must find new ways of doing business. I invite you to join us on that journey.

ImpactAlpha Interview with Achim Steiner at SOCAP17

After his speech on the MainStage at SOCAP, Steiner sat down for a face to face conversation with David Bank, Editor and CEO of ImpactAlpha. Bank’s commentary on the interview can be read in his piece for ImpactAlpha, Global Goals, Country Plans: How Achim Steiner is Making SDGs Investable.

Further Reading and Resources on the SDGs

SDGs in Action: UNDP global project for the implementation of the 2030 Agenda through the MAPS approach A publication from the United Nations Development Programme

Beyond aid: Insights from Social Capital Markets on achieving the SDGs By Catherine Cheney for Devex

Leveraging impact investing to achieve the SDGs By Catherine Cheney for Devex