“When you have Walmart in your email address, your emails are generally responded to,” jokes Rob Kaplan, now managing director of Closed Loop Partners, as he explains his early success in convening a coalition of major multinational corporate players to invest in improving the supply chain for recycled plastics in the US. “These companies wouldn’t have put five or ten million dollars into a project that they didn’t believe in,” Kaplan explains, “but Walmart accelerated the consideration remarkably.”

The year was 2013, and Kaplan, in his role as director of sustainability at Walmart Inc., had been investigating how to reduce the company’s carbon footprint by increasing the amount of recycled content in every package on millions of store shelves. When he started engaging with suppliers about the issue — companies like Coca-Cola, PepsiCo, and Procter & Gamble — he got feedback that the problem wasn’t a lack of interest in using more recycled material; rather, the challenge was lack of supply. The companies just couldn’t get their hands on enough of the right quality of recycled materials.

So from within his position at Walmart, Kaplan began trying to help solve that supply problem. He soon partnered with Ron Gonen, who at the time was head of recycling for the City of New York and a successful entrepreneur in the recycling space (later, Gonen became co-founder and CEO of Closed Loop Partners). Gonen had been thinking a lot about how to solve this problem, and had a hypothesis that the key was helping local governments get better access to capital to create the right kind of recycling infrastructure. “It doesn’t matter how much you educate people to recycle,” Kaplan explains. “If they don’t have access to a convenient curbside recycling program, they’re not going to be able to.”

It took Kaplan and Gonen about a year to identify a solution to the supply-chain challenge they were seeing. “We held a couple of meetings, virtual and in person, with mayors, recycling companies, suppliers like Coke or Unilever, and packaging companies, to really understand what was holding back the system,” Kaplan says.

A key moment was a day-long brainstorming session hosted by Goldman Sachs. More than 20 stakeholders showed up. “One of the incredible values that a Walmart brings to these types of conversations and debates is that convening power,” Kaplan explains. A popular solution that emerged was the idea for a private fund that would take the question “Who’s going to pay for this?” off the table for recycling companies and municipalities. With financing in place, stakeholders could focus on building a functional, sustainable recycling supply chain.

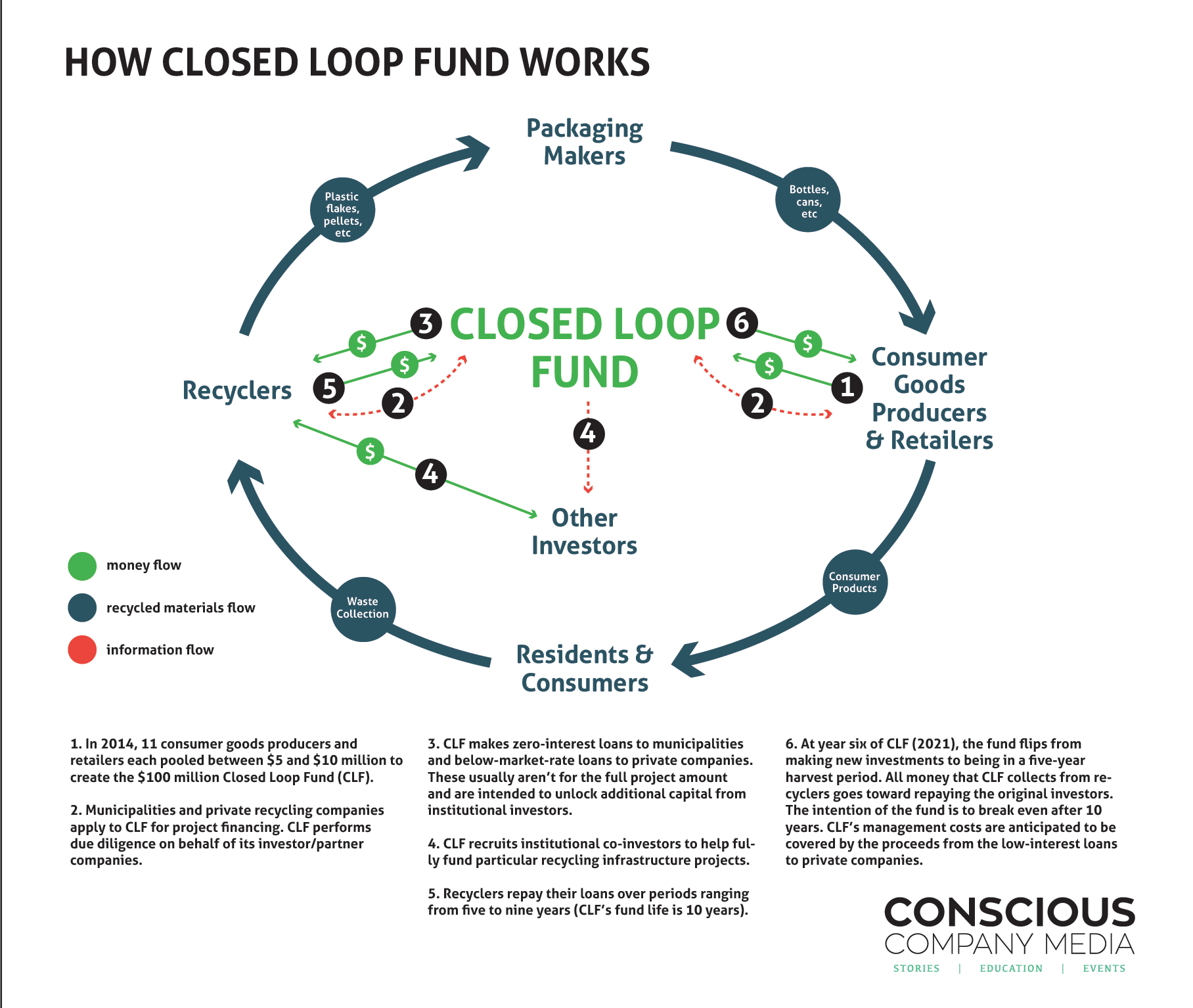

Thus was born Closed Loop Partners, an investment firm that focuses on companies, technology, and infrastructure that turn waste into value and advance the circular economy. The first Closed Loop Fund, which was announced in 2014, included investments in the $5 to $10 million range from 11 large corporations: 3M, Keurig Green Mountain, Colgate-Palmolive, Johnson & Johnson, Dr. Pepper Snapple Group, Coca-Cola, PepsiCo, Procter & Gamble, Unilever, Nestle Waters North America, and Walmart. It provides loans directly to cities and to companies to build the infrastructure required to divert plastic and other packaging from the landfill into consumer-goods supply chains.

As of summer 2018, the fund has invested about $41 million in 17 projects to unlock more than $104 million of recycling infrastructure across North America, and Closed Loop Partners is expanding. New projects include partnering with Starbucks to deliver $10 million in grants to develop more sustainable cup solutions, launching a fund to clean up ocean plastic in the waters around Southeast Asia, and much more.

We caught up with Kaplan to hear more about the lessons he’s learned in wrangling dozens of large corporations into investing — together — for the greater good.

Closed Loop Partners at a Glance

• Location: New York City

• Founded: 2014

• Employees: 10

• Traction: The fund has invested about $41 million to unlock more than $104 million of recycling infrastructure

• Recognition: First Runner-Up for the Investor Award at The Circulars 2018 (an initiative of the World Economic Forum and the Forum of Young Global Leaders)

• Structure: Hybrid

• Certifications: B Corp

• Mission Statement: “Closed Loop Partners invests in sustainable consumer goods, advanced recycling technologies, and the development of the circular economy.”

What was it like to make the business case to these companies for investing $5 or $10 million in this partnership? What is the most compelling, real reason they decided to do it?

RK: Companies are not monolithic decision-makers. They are actually an amalgamation of lots of individual decision-makers. So there are lots of things that motivate big decisions. The reasons varied based on what the company’s interests were and where they saw value. The trick of it is helping develop a business case about improving the system where a rising tide lifts all boats, and then letting each company determine what the value is of that rising tide.

For example, a company like a Coca-Cola or a PepsiCo — they have real challenges getting enough PET plastic. Procter & Gamble and Unilever don’t use PET plastic. They use more HDPE and polypropylene plastic. But you can’t solve for one problem individually; you can’t just build a PET recycling supply chain. It won’t sustain itself. The good news is that if there’s more collection, more sorting, and more processing of recyclables, including all those types of plastics, the companies can all get what they want.

Most of the capital came out of supply chain and procurement budgets, because this is about enhancing and future-proofing supply chains for these companies so they’re not 100 percent dependent on virgin oil-and-gas supplies. There’s a diversification benefit to them.

There are other reasons companies get excited about these things, too: reputation and employee engagement, a general sense of responsibility to solve this problem. But it took all of the reasons added together. If it was just reputational benefit, that wouldn’t be enough. If it was just supply chain benefit but no reputational value, that probably wouldn’t be enough. It’s working within each entity, understanding the stakeholders’ decision-making process, and helping everybody get something they need to make it a win for the entire organization.

Why is it important to have a separate entity like Closed Loop to make this happen?

RK: Paramount is the antitrust . Coke and Pepsi need to be careful about being in the same room working on this stuff. It’s illegal for them to work directly with each other. They need to work through somebody else to benefit the entire system.

What are the key lessons you’ve learned through Closed Loop Fund about creating an effective container and culture for these kinds of partnerships?

RK: It’s a lot of work. We’re actively engaged with each of our partners; we’re managing a lot of money for them. We basically have one person, full-time, managing those relationships. Part of the governance of Closed Loop Fund is quarterly in-person meetings to review all our investments, review our strategy, etc.

We’ve spent three years building our culture at that level, and that has paid dividends. We built a group that can collaborate and trust each other in a safe environment. That takes time, familiarity, and being careful about who you let in the room and how you structure conversations.

I remember when we first started, we spent a whole meeting just talking about what due diligence meant for Closed Loop Fund. It was a laborious, boring conversation, but after that, we never had to spend much time explaining our due diligence. Instead, we spent all our time talking about each individual deal.

The trick is, the culture is dynamic. People change jobs, board members leave companies, new companies join, and every time that happens we have a big cultural shift that we have to manage for. We are also in active communication with all our partners to understand where their priorities are shifting and where their new strategies are developing.

What’s the thing that people misunderstand about what you do?

RK: That we just do recycling. What we do is a lot bigger than that. It’s about the circular economy, which almost the molecular level of product supply chains. It’s not just about recycling carts. It’s about the full value chain, from collection, sorting facilities, all the way to domestic manufacturing and companies that make products that are made using recycled content. It’s easy to think about this as a 1980s or 1990s recycling kind of frame, but this is about the future of consumption.

From where you sit, including both your personal beliefs and what you see emerging in corporate America, what is the role of business in solving social problems and creating a better world?

RK: I’m obviously biased, but I think it’s critical. I’ve spent my career working on causes I believe in. I started in public policy in DC. I went to nonprofit and public policy advocacy. But we live in a capitalist society; in order for changes to happen at a systemic level, we have to do it in a way that benefits the capitalist society. The only people who can play that role directly are businesses. I don’t think we can regulate our way out of these problems. I think regulation and policy are the key enablers and can raise the floor, but it ain’t going to get us there.

Do you think multinationals are starting to embrace their role?

RK: Yeah. I think it’s a bell curve. You’ve got leaders, you’ve got laggards, and you’ve got most people in the middle who are just trying to keep the lights on, do their part.

I remember having a great conversation at Walmart where one of the business leaders I was talking to said, “Look, I don’t want to kill baby tigers. I want to know what we have to do to stop this. But I don’t have time to understand it myself. I’m just doing my day job.”

For the last 10-plus years, a lot of these companies have been going down the maturity curve of : finding their baseline, setting their first set of goals, achieving those goals or not, and setting their next set of goals. It’s getting increasingly sophisticated, which means increasingly more impactful. I see a lot less interest from corporates just to do CSR for the sake of doing it or on the side. They’re more asking, “How does this strategically enhance our industry or our business?” Historically, people were ashamed that we would be making money by doing the right thing. Now I see more and more companies interested in focusing on that.

What’s your advice to someone trying to partner with people within large multinationals, maybe on an impact project like Closed Loop Fund?

RK: Recognize that they are people. It’s so easy to say, “This company is evil.” Companies aren’t evil any

more than they are good. They’re not motivated in a human-emotion way. The individuals are.

And individuals on the sustainability team are usually your biggest advocates. They agree with you, probably with everything you say. Then their challenge is “How do we get the people inside the company who actually make those decisions to agree with us?” How does one do that in a way that doesn’t demonize them individually and cause them problems, but rather is a solution-

provider for them, so that people inside the company that you’re trying to influence want your help? You’re not just pointing out the problems, you’re pointing at the solutions.

Eighty percent of the people who engage a corporation are problem-identifiers. “You should do something different on palm oil because palm oil is bad.” The answer typically is, “We know that, but here are the 45 reasons why it’s intractable. Help us with one of them.”

There are very smart people at each of these companies working on these challenges. If they’re not making progress, it’s because the solutions aren’t apparent. In an engagement with the corporation, how do you focus on being a solution-provider rather than a problem-identifier? There are plenty of problem-identifiers out there already.

Do you have any tips for being a good solution-provider?

RK: Bring deep expertise in the sector that you’re trying to be a solution-provider in that will help fill gaps. In our case, our partners want to develop solutions in Southeast Asia, where their businesses are growing, to prevent their plastic packaging from getting into the ocean. The research shows that more than half of the plastics flowing into the ocean are generated in Southeast Asia, and this is because those markets have long coastlines and rivers. They have rapidly developing economies where they’re producing exponentially more waste than they used to, and it looks more like Western waste, and there’s no waste and recycling infrastructure in those communities.

In partnership with the Ocean Conservancy, we’ve created an initiative called Closed Loop Ocean that is focused on figuring out how we can develop a financing mechanism to catalyze investment from institutional investors and other institutions to build the infrastructure required to prevent waste from getting into the environment.

Our approach is to figure out how to develop that pipeline of investable opportunities to say, “Here’s what it would look like,” or “Here’s how we can incubate opportunities on the solutions because there aren’t enough out there, and it would require this kind of capital commitment, but we’re bringing the technical expertise to the table.”

How would you fund that kind of deep solutions research before you have a committed corporate partner? It seems rather chicken-and-egg.

How would you fund that kind of deep solutions research before you have a committed corporate partner? It seems rather chicken-and-egg.

RK: We put a proposal together and said, “This is how we would solve this problem. Phase 1 looks like this kind of research and this type of convening. Phase 2 looks like this kind of research and this type of capital commitment. Do you want to do this with us? We’re serious. We’ve got the right partnership together. We’ve put the pieces in place. You’ve identified this problem. Here’s a way to develop a solution. We don’t have all the answers, but here’s how we go about answering them in partnership with you.”

And that worked because there was not a lot of competition for solution-providers. Everyone was looking for some way to address this challenge — and not just the corporations, but governments, development agencies, and nonprofits.

Historically, a lot of the approaches to solving big issues like this have been critical rather than enabling. Activist organizations would be running boycotts or campaigns against the corporation to get them to agree to a new policy, or something like that.

So it’s a matter of deciding, as people who care about an issue, to invest in a collaborative, enabling framework instead of, or in addition to, an oppositional one?

RK: Right. I’d say “in addition to,” because they both serve their roles and their parts. But emotionally different skills are required. When you’re doing the collaboration side or trying to be the solution-provider to offer value for lots of people, you will compromise. If you are a purist, that may be really frustrating for you.

I find I have a very high tolerance for the frustration, and I’m okay with envisioning moving a mountain, and in reality moving it a couple inches by the end of the day. I’m happy about that couple of inches. But that’s my own personality. A lot of people would not find it satisfying.

You’re very tuned in to the nuances.

RK: And what the actual work is, what it means to be working with these companies on a day-to-day basis. It’s not as exciting as it might sound. It’s a lot of PowerPoint presentations, phone calls, and meetings where you’re trying to move people and influence them in a lot of different ways. That’s a different skillset than hanging banners on the company’s headquarters.

What’s your big audacious goal at Closed Loop Partners? In 10 years, do you see yourselves going beyond recycling?

RK: There are lots of adjacent areas, like transportation for example, where I could see a corporation investing in their supply chain in a way that would benefit them and the environment at the same time.

It’s this idea called “catalytic capital.” The goal is to unlock or enable institutional investors to deploy money into these sectors. We don’t plan on managing billions of dollars. The opportunity here is to show that these investments are bankable, these sectors are investable, and thereby to attract institutional capital to those sectors. We want to use our unique capital, which is more flexible and more impact-driven, to bring those returns so that investing in waste and recycling, for example, is as boring as investing in bridges and roads.

What’s giving you hope?

RK: The way the public — and private — sector has been reacting to the ocean plastics issue has been exciting in the last year and gives me a lot of hope. The great thing about this issue is everybody’s against it. It’s not like climate change where you have to debate somebody about whether it exists or why it’s important. Everybody you ask thinks there should not be plastic in the ocean, which means that it’s one of the more solvable environmental challenges we’re facing today. That gives me hope.

The Closed Loop Family of Ventures

Though Closed Loop started with a specific project — Closed Loop Fund — the organization’s larger mission is to help finance the whole spectrum of innovation and infrastructure required to move to a circular economy (a system in which “waste” becomes an input to some other value chain). Because of its systems-level point of view, the Closed Loop family of ventures continues to grow and morph. “Different opportunities require different types of capital,” says co-founder Rob Kaplan. “Early-stage research and development needs philanthropic money. Startups need venture capital. Later-stage infrastructure needs project finance. We’ve built impact investment products to solve for the gaps.” Here’s a snapshot of what the group is up to as of press time.

• Closed Loop Foundation – A 501(c)(3) nonprofit that funds the research and development of technologies and business models focused on building the circular economy.

• Center for the Circular Economy – This new for-profit entity aims to host a physical space that accelerates new materials and companies. Example project: a NextGen Cup Challenge in partnership with Starbucks.

• Closed Loop Ventures – A for-profit fund for individual and institutional investors, funding early-stage sustainable consumer-goods startups, advanced recycling technologies, and services related to the circular economy.

• Closed Loop Fund – Project finance that invests in scaling recycling infrastructure and sustainable manufacturing technologies that advance the circular economy; a for-profit designed to break even (see page 58 for details on its model).

• Closed Loop Ocean – At press time, this project of Closed Loop Partners was exploring how to properly resource and structure an initiative in South and Southeast Asian countries to invest in financing innovation in waste and recycling infrastructure specifically addressing ocean plastic pollution.

How would you fund that kind of deep solutions research before you have a committed corporate partner? It seems rather chicken-and-egg.

How would you fund that kind of deep solutions research before you have a committed corporate partner? It seems rather chicken-and-egg.