SOCAP Guest Post by: Annie Chor, Annie Dear, and Elly Bringaze of Social Finance

Annie Chor

Annie Dear

Elly Bringaze

To bring more of the SOCAP Community into the conversation, we invited SOCAP18 session leaders, speakers, and attendees to share their major insights and takeaways from the conference.Nearly three decades since the launch of the earliest Socially Responsible funds, the impact investment industry has grown tremendously. Estimates indicate that the market could reach hundreds of billions in assets under management over the next decade. Yet, as it grows, the industry continues to grapple with the challenge of impact reporting. Investors are increasingly seeking information about the measurable impact of their dollars, which drives the fundamental question how do practitioners accurately measure the impact of an investment?

The question was a common thread across many of the speeches, panel discussions, and workshops at SOCAP18, an event that Lindsay Smalling, CEO of SOCAP, described as kicking off “the next decade of impact.” At Social Finance, we believe that addressing the world’s complex social and environmental issues over the next decade will require a commitment to strong impact measurement. Over the past eight years, we have helped pioneer the Social Impact Bond (SIB) and the field of Pay for Success (PFS), which we believe can pave the way as the field considers what true impact looks like and how to measure it. In the traditional SIB and other PFS strategies, financial return is directly linked to defined social outcomes; and thus, impact measurement is a critical element of every project.

Following the development of the Social Impact Bond, the Pay for Success field has evolved to include other strategies that tie directly dollars to impact. This includes partnering with for-profit service providers and using new repayment structures such as income sharing agreements (ISAs) that directly tie payment to measurable employment and earnings outcomes. It also encompasses outcomes rate cards, which allow government to create a menu of outcomes it hopes to achieve and establishes a price that it is willing to pay for each metric. In all of these strategies, determining the appropriate outcomes and methodology for measuring impact is an essential part of the investment structuring process.

Beyond the SIB

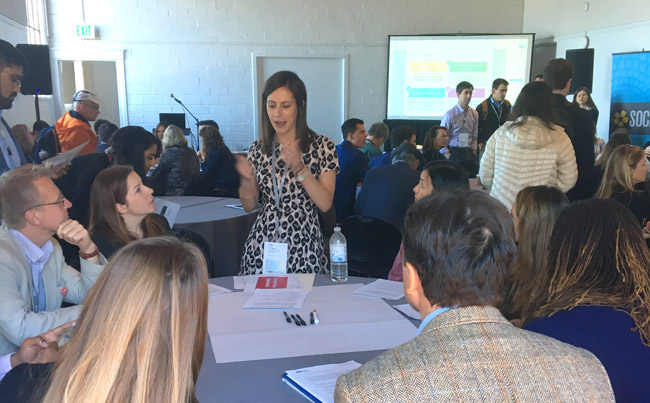

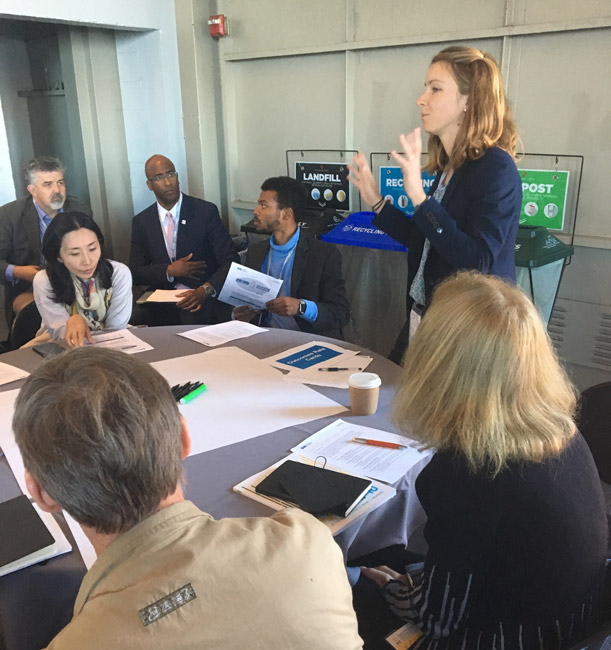

Social Finance hosted an interactive workshop at SOCAP 2018 to discuss these new tools titled Beyond the SIB: New Applications of Outcomes Based Financing. The session highlighted the evolution of the PFS market and the development of PFS principles. Over 100 practitioners – ranging from investors to philanthropies to service providers – broke out into smaller groups to discuss a PFS tool that resonated with their own work:

- The “classic” Social Impact Bond to address social challenges.

- The Environmental Impact Bond to link sustainability and social outcomes.

- Income Share Agreements to improve workforce development outcomes.

- Outcomes Rate Cards to reframe how governments and agencies contract towards outcomes versus outputs.

The critical importance of impact measurement emerged as a common theme across the various PFS tools. The four core principles of PFS – a focus on clearly defined outcomes, contracts that link payment to performance, use of data to guide decision-making, and strong governance – would not be possible without adequate measurement of a project’s impact.

The critical importance of impact measurement emerged as a common theme across the various PFS tools. The four core principles of PFS – a focus on clearly defined outcomes, contracts that link payment to performance, use of data to guide decision-making, and strong governance – would not be possible without adequate measurement of a project’s impact.

Cambyse Parsi from BNP Paribas, participated in the Beyond the SIB session, whose diverse audience he described as a “testament that success requires partnerships between many types of organizations.” He added that “The Pay for Success contract model is being expanded beyond Social Impact Bonds and clearly has the power to unlock significant capital towards both social and environmental impact initiatives.” Overall, the workshop was an energetic demonstration of the power of Pay for Success in uniting different organizations around a common challenge of solving the world’s most pressing social and environmental problems.

Impact Measurement Throughout SOCAP

Throughout the week at SOCAP, many sessions considered questions about how to embed impact measurement across the full spectrum of products and asset classes. An informal discussion group broke out that recognized the need for “quality, transparent impact measurement.” Dash Cochran, Founder of Evaluation Essentials, highlighted that investors are weary of ‘success stories’ and activity logs that offer no real actionable feedback on how impact-oriented organizations are actually making a difference.” The group noted “the lack of consistency transparency, and best practices,” which further speaks to the crucial nature of establishing standards within the industry as part of the next decade of impact.

On a similar note, the Artful Science of Underwriting for Impact panel highlighted the need for rigorous evaluation on both the impact and financial side of the investment evaluation process. One audience member inquired about the idea of a blended IRR that combines the financial and social return of an investment. Panelists noted the importance of setting ex ante impact targets—just as funds typically do for financial performance. Additionally, they presented different approaches to identifying impact metrics, such as using research and/or past performance to set targets, and the need to evaluate whether those targets have been met.

The group also reiterated a lack of industry standard for impact measurement – each firm has their own scorecard for impact that reflects their respective priorities and values. The discussion acknowledged that meeting impact goals is challenging and that committing to impact measurement will sometimes reveal discouraging results, but this should not dissuade efforts to refine the measurement process. Overall, the session emphasized a clear need for accountability and rigor in how firms embed impact into the process of assessing their portfolios.

The impact measurement question culminated late Thursday in a session titled Setting the Bar for Impact Measurement during which a panel of practitioners addressed the question head-on. The discussion gravitated toward the Global Impact Investing Network’s recent “Impact Management Project,” a global effort to set standards for measurement and management. Across the board, panelists agreed on a need for an accessible approach for assessing the basic principles of impact:

- Why – What are the impact and financial goals of the investment?

- Who – Which populations are being targeted?

- What – How do investors choose the right business models or services?

- When – Over what time frame are investments and projects being executed?

- Where – In what geographies are capital and services being deployed?

While they agreed on the need for impact measurement, the panelists also acknowledged several challenges and nuances of quantifying impact. Graham Macmillan from the Ford Foundation cautioned that “measurement matters but pursuit and intention matter more.” He emphasized the need to find a narrative that these numbers represent meaningful change because “values aren’t metrics.”

Other panelists agreed that it can be a challenge to convince people of the need for measurement. Kay-Hay Law, a representative of the Lundin Foundation and AHL Venture Partners, stressed that there can be resistance to setting annual impact targets analogous to financial metrics. Jamie Martin of Morgan Stanley highlighted that impact means something different to each and every client and is highly dependent upon personal values. Thus, answering the traditional “How am I doing?” question from clients in regard to impact can be tricky.

The panel wrapped up with a question of “setting the bar” and the implications of establishing industry standards. One panelist noted that setting a “bar” may ultimately lead to the next evolution in the market –performance evaluation in which investments are compared to an impact benchmark. She noted that a performance evaluation process could be an incredible opportunity to set impact standards but is also imbedded with significant risk. Overall, the group reiterated the need for measurement but also cautioned practitioners on the potential challenges of enforcing metrics in an industry that is highly driven by organizational missions and personal values.

“The Next Decade of Impact”

Throughout the four days of SOCAP, impact measurement was clearly a central theme across a wide range of sessions and conversations among attendees. Whether it was investors inquiring about the impact of their dollars or service providers evaluating the effectiveness of programs, the development of measurement standards is clearly a critical step in the evolution of “the next decade of impact.”

Pay for Success inherently embeds a direct link between impact and financial performance in that each dollar of return represents a meaningful change in the life of an individual. Sindhu Lakshmanan, a SOCAP attendee from Living Cities, reiterated how Pay for Success takes impact measurement a step further by focusing on outcomes: “Typically, investors track inputs or, at best, outputs. These are necessary but insufficient. Pay for Success presents a way to go beyond tracking dollars invested and actually track people—for example, are participants spending fewer days in jail, are they getting jobs, and are they increasing their incomes?”

Pay for Success is just one example to help guide the impact industry as it begins to set standards for measurement. As we move into the next decade, the field is actively grappling with how we measure and report our impact on people and the planet. Doing so will be critical for building a robust movement capable of realizing its full potential and making meaningful progress in addressing the world’s biggest social and environmental challenges.

Pay for Success is just one example to help guide the impact industry as it begins to set standards for measurement. As we move into the next decade, the field is actively grappling with how we measure and report our impact on people and the planet. Doing so will be critical for building a robust movement capable of realizing its full potential and making meaningful progress in addressing the world’s biggest social and environmental challenges.

Elly Bringaze is Associate of Capital Formation and Investor Relations at Social Finance

Annie Chor is the Associate Director of Strategic Partnerships at Social Finance.

Annie Dear is an Associate Director at Social Finance, where she supports the Advisory Services and Social Investment teams.

Additional Resources

Listen to episode nine of the SOCAP Podcast Money + Meaning on Pay for Success.