A SOCAP Guest Post by Dan Carol, Director in the Milken Institute Center for Financial Markets

There was a LOT of talk at SOCAP19 about how to scale up the impact deal pipeline. The big mountain range we all agree is worth hiking towards is pretty clear: community-led development, inclusive growth, and equitable and resilient local economies.

The question, of course, is how to accelerate the climb. From the conversations that I heard and participated in, I gathered that the chatter at Fort Mason kept coming back to four key “impactful” themes:

- Communities need a clear story and a marketing prospectus to attract impact (including Opportunity Zones) investors to their town.

- Communities need talented people (aka deal jockeys) who have the skill set and capacity to stack up multiple capital sources and weave together complicated deals in big cities like Atlanta to Baltimore and in smaller communities in states from Alabama to California.

- Communities need to figure out how to incorporate the new Opportunity Zone tax incentives into their impact investing strategies. What are Opportunity Zones (OZs)? OZs are a new initiative created under the 2017 Federal Tax Cuts and Jobs Act, which provides incentives for qualified investors to invest capital gains in 8700 distressed communities across the United States. The idea is based on bipartisan legislation originally introduced by Senators Tim Scott (R-SC) and Cory Booker (D-NJ). OZs have their shortcomings and that’s why the Milken Institute and others are working to strengthen their potential to catalyze innovative impact deals by adding strong reporting requirements and other incentives for stronger social and environmental outcomes, while still effectively engaging over $65 billion of new OZ Fund equity now looking for investments.

- Communities that don’t have a serious predevelopment funding strategy in place will find it harder to catalyze impact investing and OZ deals in their town. Because predevelopment can be the secret sauce for successful economic development programming, closing this gap quickly is a must.

Remind me again–what exactly is predevelopment?

Predevelopment is the funding that pays for tasks that need to be completed before project construction and outside investment can occur, such as architectural, design and engineering work, market assessments and economic feasibility studies, site/lease acquisition costs, business plan writing, and permitting. For more, go check out the Federal Build America Investment Initiative report:

“Although only accounting for a small percentage of total costs, predevelopment activities have considerable influence on which projects will move forward, where and how they will be built, who will fund them, and who will benefit from them.“

“Greater attention to the predevelopment phase could yield a range of benefits — for example, providing the opportunity to develop longer-term, more innovative, and more complex infrastructure projects and facilitating assessment of a range of financing approaches, including public-private partnerships. Additional investment in predevelopment costs also may enable state, local, and tribal governments to utilize innovations in infrastructure design and emerging technologies, reduce long-term costs to infrastructure project users, and provide other benefits, such as improved environmental performance and enhanced resilience to climate change.”

Why is predevelopment funding so critical?

So who is willing to pay upfront for innovative, high impact deals that have never been done before? The average investor? Not so much. She or he are looking for high returns and easy-to-do deals that have been done before, not extra time and expenses doing feasibility and risk studies on how to crack the code on a new breakthrough product like environmental impact bonds.

Even most impact-oriented investors, with rare exceptions, generally expect the public sector or philanthropy to foot the predevelopment capital bill, which is typically 5-10% of total project capital costs. Most impact investors also don’t like to be first; they often like others to pave the way, sometimes with sewer lines or other development basics. That can come through state support, local initiatives and sometimes through philanthropic help. Typically, pre-development funding through grants or loans are repaid if a project is developed, but forgiven if the project does not move forward.

How have communities filled the predevelopment gap?

One of the best early examples of public predevelopment funding was created by the City of Portland Development Commission (PDC) and Enterprise Community in 1997. Portland’s initial predevelopment loans were for up to $200,000. Eligible uses included land acquisition, preliminary design (the “fat line” stage of drawings that allow preliminary cost estimates), and site studies such as geo-tech and environmental. If an affordable housing project didn’t advance, the agency would generally buy the studies from the developer, effectively forgiving the loan in exchange for the site and project data.

Portland’s Predev Fund, paired its predevelopment support with a $25 million affordable housing bond and catalyzed 3,000+ units of affordable housing over 8 years at a time when costs were rising faster than incomes. Predevelopment risk capital helped fill the critical gap to move these deals to reality because it substituted for the most expensive money in the capital stack and reduced the long-term debt service.

Pittsburgh’s redevelopment success story — from a dying Rust Belt City to a newly-vibrant Robotics City — was also initially anchored by the creation of a $60 million predevelopment fund in 1996. According to former Mayor Tom Murphy, now a Senior Fellow at Urban Land Institute, the Pittsburgh Fund has been recirculated four times.

Cincinnati’s success in redeveloping the city’s Central Business District and the adjacent neighborhood of Over-the-Rhine (OTR) also relied on the first money that came from The Cincinnati Center City Development Corporation (3CDC), a nonprofit, privately led full service real estate development and finance organization formed in 2003. 3CDC leveraged significant capital funding from Cincinnati corporate partners by overseeing management of Cincinnati New Markets Fund and Cincinnati Equity Fund, two private loan funds targeted for downtown and urban redevelopment.

Most recently, Erie, Pennsylvania has garnered well-deserved national attention for attracting early Opportunity Zone investments ahead of many other communities. At the heart of their success? Like other cities, Erie assembled deal jockey assistance and did an investment prospectus. But they also checked one more critical box: they assembled catalytic predevelopment funding provided from the Erie Downtown Development Corporation and the Erie Insurance Company.

Government need not be the only critical actor in the predevelopment game. In New Orleans, for example, after Katrina, the Entergy Corporation provided $200,000 in gap financing to allow the nonprofit Volunteers for America to hire the expertise they wanted to shape what became a 200 unit, $84 million affordable housing deal for low-income seniors The Terraces on Tulane Avenue. Volunteers for America lacked the in-house expertise who knew how to develop a capital stack, do predevelopment and access New Markets Tax Credit and private funds. Now this team has created its own spin-off, the Renaissance Neighborhood Development Corporation, which has rehabbed or built out another 1000 affordable units. This was all catalyzed with one $200,000 predevelopment grant in 2006.

Worried about how and where your community can assemble predevelopment capital? Check out these sources of predevelopment capital available to tap into, including support from the US Economic Development Administration, the US Department of Agriculture Rural Development program, HUD and others. Or you can take steps to create your own revolving loan fund guided by experts like the Council on Development Financing Agencies.

So what’s my community’s next move?

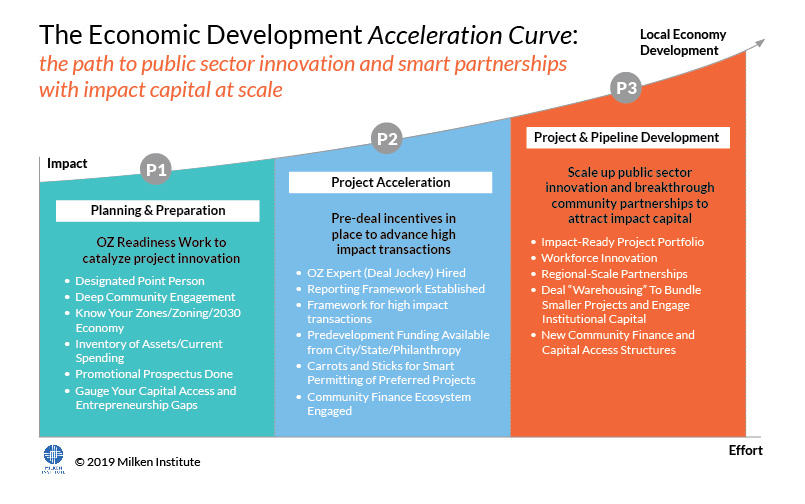

If your community doesn’t yet have its own prospectus, the right people in place, a plan for engaging Opportunity Zones or a predevelopment funding strategy, all is not lost. There is still time to go up the Impact and OZ Acceleration Curve and build the right community capacity to intelligently engage private capital looking to invest in your town for the long-term.

The Economic Development Acceleration Curve: the path to public sector innovation and smart partnerships with impact capital at scale

Research from McKinsey and Georgetown indicates that the same set of innovative steps and reforms that many cities need to take to build a more resilient and equitable local economy will concurrently accelerate the development of a stronger pipeline of investable and shovel-ready Opportunity Zone and impact investment projects.

The three phases of effort roughly look like this:

Phase 1: Public sector preparation to get ready to effectively engage with potential OZ and impact investors and do it in a way that builds community cohesion and shared purpose;

Phase 2: Strategic acceleration of the first wave of desirable and shovel-ready projects through easily-deployed tactics and techniques;

Phase 3: Permanent investable project pipeline development to transform local economic development through partnerships and innovative reforms.

To help facilitate this shift towards 21st Century Economic Development partnerships and community wealth-building, The Milken Institute, Accelerator for America, Economic Innovation Group, Sorenson Impact Foundation, and other partners are staging regional training “boot camps” (such as this Opportunity Zone workshop series in Mississippi) for public sector leaders across the country to help communities go up the “curve.”

The bottom line is pretty clear: most impact and OZ investors are looking for shovel-ready projects and ready-to-invest businesses.They aren’t much interested in deals that are only promising 1-page concept papers, but not quite ready for prime time. In public sector parlance, investors are looking for deals that have already done the predevelopment work and have their permits in place. So that’s why predevelopment is a must!

Dan Carol is a director in the Milken Institute Center for Financial Markets, expanding our work with local governments and stakeholders to foster best practice implementation of the Opportunity Zones Initiative and accelerate community and regional innovation.