Despite increased awareness and conversations around creating an equitable and just economy, the investing community still puts most of its capital behind businesses that are white and male-owned. This is partially because more than 98% of the $69 trillion in the U.S. asset management industry is managed by firms owned by white men. However, with steadily growing diversity in the business and investing worlds, there are more people trying to move money to founders and communities of color.

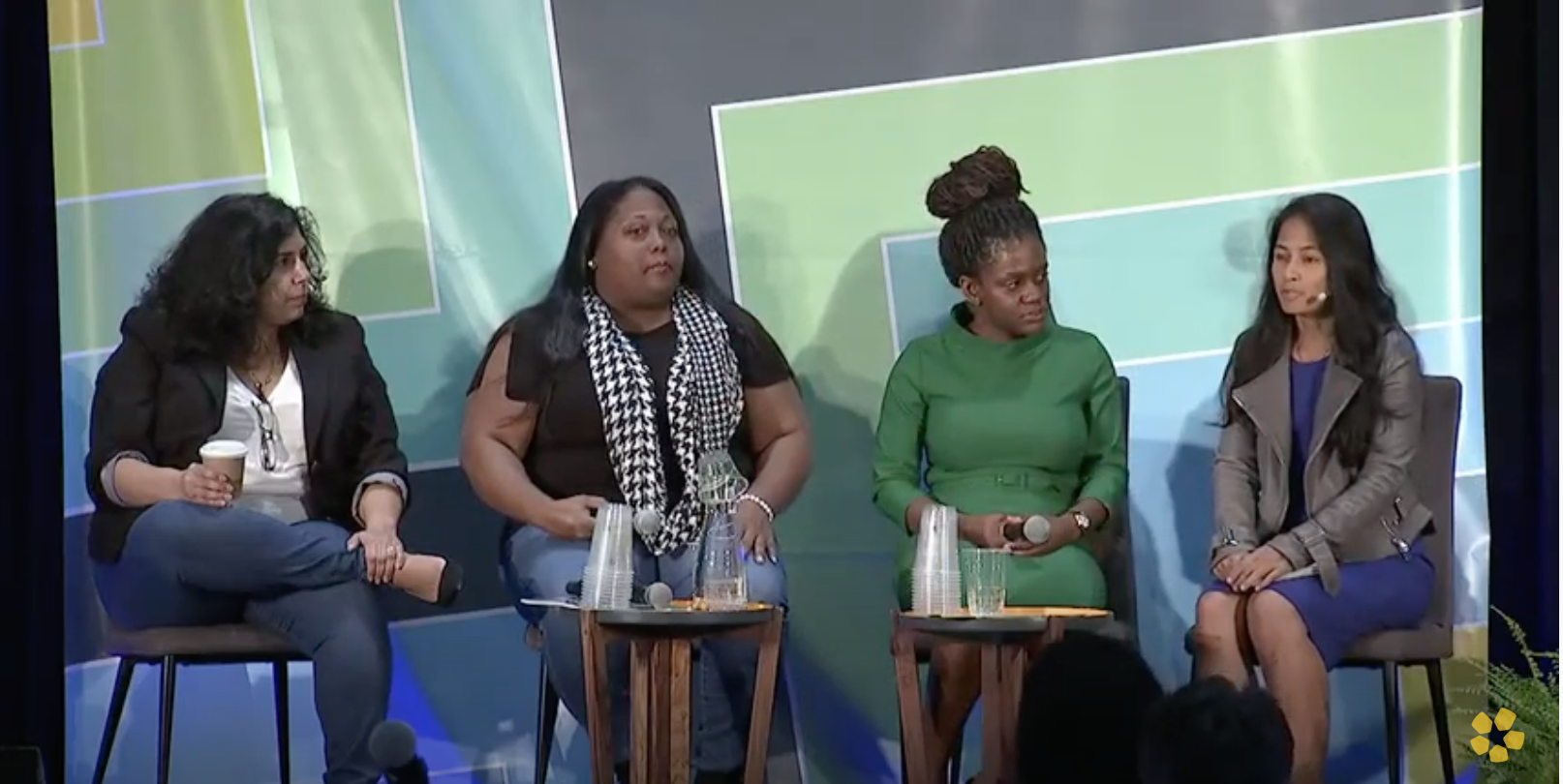

In a SOCAP19 session, founders and investors of color came together to share their experiences and what they’ve learned from them. They also shared their tips for other founders of color and insights for how to make the process of funding more equitable.

“We spoke a lot about communities and access,” Savina Perez said. “And as an entrepreneur, as a founder, one of the biggest challenges that we face is awareness and understanding what is actually out there for us to be able to tap into.”

The panelists included:

- Elizabeth Reynoso, Associate Director for Public Sector Innovation, Living Cities

- Monique Woodard, Founder and Managing Partner, Cake Ventures

- TD Lowe, Partner at 42Phi Ventures and Founder of EnovationNation Inc.

- Savina Perez, Co-Founder and Head of Growth, Hone

There was also a video-recorded message from Dr. Tye Caldwell, co-founder and CEO of ShearShare, and Courtney Caldwell, co-founder and COO of ShearShare, who shared their own experiences trying to secure funding.

Watch the session or read the full transcript below.

Watch Connecting Founders of Color to Community and Capital

Elizabeth Reynoso: Thank you for having a breakfast conversation with us. So we love this intimate, if you want to come closer we don’t bite. Thank you so much for joining us this morning. I’m Elizabeth Reynoso, and I am the Associate Director for Public Sector Innovation with Living Cities. I’m thrilled to be here to speak with you today and be joined by some amazing women who you’re going to hear about. You’re here this morning, because something about our title, Connecting Founders of Color to Community and Capital, means something to you we hope. Some of you may have already been using your roles as gatekeepers in your communities, in your institutions.

Well, some of you might be exploring how you could do that, and some of you understand the journeys of entrepreneurs of color. And some of you are still exploring that as well. Well, Living Cities, Sirna Foundation, and Rockefeller Foundation came together to say that without the role of the fastest growing population in the United States, being part of this country’s economic engine, we will not have success in this country. So living Cities, Rockefeller Foundation, Sirna came together to Start Up, Stay Up, Scale Up.

Start Up, Stay Up, Scale Up is an initiative that started about 18 months ago, and we are focused on high growth entrepreneurs. Why? Because when we think about closing racial gaps in income and wealth, when you focus on high growth entrepreneurs, they can exponentially change the local economies in our communities around the country.

And so we started working with three communities, Albuquerque, New Orleans, and San Francisco, three distinct communities, with their own histories, rich and unique with their own industries, sectors, cultures. And what we found is that some of the challenges that folks face in New Orleans are similar to the ones they face in Albuquerque, and surprisingly, even in San Francisco, right? Everybody thinks you come here for this robust ecosystem, and yet, it’s so exclusive. We’re going to hear some of those stories today from a founder, from an investor, and all of these folks here are community ecosystem builders. But I want to bring in a voice into this conversation of founders who came to Silicon Valley looking for that access to capital and community. Adrian, please. Short video

Dr. Tye Caldwell: We’re the Caldwell’s. I’m Dr. Tye Caldwell, I’m the CEO and co-founder of ShearShare.

Courtney Caldwell: I’m Courtney Caldwell, co-founder and COO of ShearShare. So ShearShare is the first mobile app that lets stylists, licensed professionals, rent a salon and barber shop space by the day. We firmly believe that the future of beauty and barbering is owned by the independent. And so we were just trying to solve our own problem. And here we are six years later solving it for thousands of hosts around the nation.

It started with us bootstrapping, actually, well, this was again before we even knew that there are people out there called angels or VCs, who would go on this journey with you. And so we just did what we knew back then what to do, like you find a problem, you fix the problem, and you find your own problem. After that though, we learned about the accelerator programs out in the bay.

Our first check in came from Black female, our first VC came from Black female, our first advisor came as a Black female. And it wasn’t like we were out there looking for that person. And I think they just understood the gaps that we were trying to fill in the industry and how best to do that. And they firmly believe that we were the two people to be able to pull that off.

It’s the one thing that when you walk in, no one can ask like, “Oh, are they Black?” I mean, they clearly see that, it’s written all over us. I remember the very first meeting that we had you remember this?

Dr. Tye Caldwell: Oh my God, tell them.

Courtney Caldwell: The very first investor meeting, this was like our “Welcome to Silicon Valley” moment. We walk into the room, two gentlemen are sitting on the other side of us, we pop open our computers, we’re about to present our startup deck. And before we say anything, before we even introduce ourselves, one gentleman says, “Oh, wow, it’s really good to see that you guys aren’t two white founders from Stanford.”

Dr. Tye Caldwell: “Six foot tall.”

Courtney Caldwell: Yes, he actually gave a height. So you’re thinking, where do I go from there, what do I say, do I just kind of laugh it off, brush it off and jump right into my pitch? Or do I say, thank you so much for your time and exit stage left?

Dr. Tye Caldwell: You don’t really know how to take it, we are people that see past all the fluff. And so to say that was, it wasn’t offensive, it was just a level of ignorance that they’re used to seeing. And so we just embraced it. And we know now, Courtney and Tye, welcome to Silicon Valley, nothing surprises us anymore.

Courtney Caldwell: Nothing, nothing. No matter what, what we see and hear every day from our community is that, one, we’re helping to keep small businesses open, that’s huge for us, we’re helping people be able to launch out and start their careers from day one, which has never before been able to happen. But at the end of the day, I feel our biggest impact is that we have put our thumbprint on small businesses in America because that really is the backbone of American economy. And so what we’re doing is helping to serve as a wealth creation engine for people who love this industry.

Elizabeth Reynoso: Thank you. That’s Courtney and Tye Caldwell of ShearShare, founders who started in Dallas Texas and came to Silicon Valley. So some of you might realize that their experience is typical. Some of you might not. But someone who has seen ecosystems thrive, someone who has been helping them thrive, both locally, nationally, and globally. With someone that we were able to recruit to help us in the design of Start Up, Stay Up, Scale Up that was designed to close the gaps in the entrepreneurial ecosystems in communities.

We enlisted the help of Monique Woodard, a venture capital investor, who was able to coach the cities of Albuquerque, New Orleans in San Francisco. Monique, could you tell us about your experience, and what you saw across the country and what was happening in these three cities.

Monique Woodard: Yeah. So just to give you a little bit of background on who I am. I’m a San Francisco based venture capital investor, I used to be at 500 Startups, which is a global venture capital firm. And that’s how I got to know the founders of ShearShare, because we invested in them while I was there. And I’ve since left to start a new fund called Cake Ventures. But I have a long history of backing Black and Latino and women founders all over the world.

And one of the things that I noticed when I initially moved to San Francisco 11 years ago, was that, at the time I was an entrepreneur, and all my friends are entrepreneurs, and so we knew each other as Black entrepreneurs, but we felt that we were sort of outside of the gates where other entrepreneurs were able to go much further. And so we started an organization called Black Founders here in the Bay Area, but then we expanded all over the United States. And as I was building the Black founder’s ecosystem, the thing that I noticed was that we could do all the programming in the world, we could do all of the founder coaching and advising, but unless we were able to touch capital, all of that was for nothing.

And so that’s how I ended up moving on to the venture capital side of the table at 500 startups at first, and then recently left 500 to start a new fund. 55% of my companies are female-led companies. And if you all saw that big Vanity Fair article a year ago, with all the Black women who have raised a million dollars or more in venture capital, an unfortunately very short list, I’ve invested in four of them. And a fifth one since that article has come out.

And roughly 60% of the companies that I’ve invested in, have underrepresented founders of some sort, whether that’s a Black founder, like Morgan Bond, Blavity, Latinx founder, the founders of Encantos, or older founders like Wendy at Silver Nest. So, my founder portfolio looks very different than you would see in any Sand Hill Road VC firm. And as a result, I was really drawn to what living cities and Sirna and Rockefeller were trying to do with startups: start up, stay up, scale up, because, one I know that good companies can start anywhere. And you were seeing a huge outpouring of entrepreneurs and of talent out of San Francisco for many different reasons, which I think maybe TD will get into a little bit. But New Orleans and Albuquerque and Denver, and lots of other ecosystems are the beneficiaries of some of that outpouring. And unfortunately, they lack capital to support that entrepreneurial ecosystem. And so how can we get more capital into those ecosystems, and really help them thrive. And really think about these emerging and new ecosystems, building on a more inclusive base.

And so that was really how I came to Start Up, Stay Up, Scale Up or SU cubed, let’s call SU cubed, because that is a mouthful. That’s how I came to be involved with SU cubed, and got to know the teams in New Orleans and Albuquerque and started talking to them about some of the challenges that they were having. Let’s stop there. And we’ll talk more about that.

Elizabeth Reynoso: Yes, thank you. And so when we worked in each of these communities, we wanted to find someone who could be a lead, someone who was potentially a powerful convener, someone who has had relationships with entrepreneurs of colors and particularly understood the high growth founders challenges. We have in the room a representative from our New Orleans group, New Orleans Business Alliance, Lynette is right here. You can talk to her about her experiences. But here on stage with me, I have TD Lowe from 42Phi ventures. And Monique, you found TD and brought her into this work because she was already doing it.

Monique Woodard: Right. So I knew TD, TD and I actually met personally. A friend of ours connected us and he was just like, “Oh, you should know each other.” And so we got to know each other and obviously hit it off really well. And then I brought her in for some of the accelerator interviews at 500. And realized she was incredibly smart. And just kind of had this professional mental falling in love with TD. And so when we were looking for someone who could manage the San Francisco portion of the SU cubed work, TD was sort of the first person on my list. And luckily, she was available, already doing a lot of this work through 42Phi ventures, she has a relationship with ShearShare as well, as well as with Savina. And so I knew that she was passionate about some of the things that we were also passionate about, and was also just a really great person to work with.

TD Lowe: Thank you so much, Monique. So, like Monique said, she and I came to know each other through a mutual friend who introduced us. And though both of us have taken different paths in Silicon Valley in San Francisco to be where we are. Today, we’ve had a lot of very similar experiences. And one of the things that I realized as a first time founder, just a bit about myself, I came to the valley seven, eight years ago now. And as a first time founder, even at that time, it was still an incredible hurdle to overcome when it came to raising capital. And I can remember sitting in front of a very, very, very well known venture capitalist, pitching to him, and him banging on the table in front of me in anger asking me, “Who did I think I was that I could make innovation accessible to everyone? Who did I think I was?”

And that was a wake up call for me. And I realized that the barriers were purposeful. They were systematically put in place on purpose. And it wasn’t by accident, wasn’t by ignorance, it wasn’t by anything else. So at that moment, I committed myself to say, you know what? You might not invest in EnovationNation, because we are usurping the government and their inadequacies. And we’re also exposing through our work, the fact of what you’re not doing. So I’m now determined more than ever to ensure that entrepreneurs, people who have ideas, who are innovators, that their innovations will get to market.

And so this is how 42Phi ventures was birthed. It was birthed because we had a desire to break down the wall between where ideas happen, and founders who are underrepresented in women and where the capital is. And one of the things that I’ve learned, I grew up in Alabama, I’m a southerner, Southern Belle, I grew up in Alabama and growing up in Alabama, you understand there’s a dynamic of race relations that you understand that sometimes you can’t get if you live in California. If you’re from the south, there’s just a different understanding that you have, and so one of the things that I learned growing up is that acceptance and being able to participate in the system does not come because you ask, because you say nicely, “Hi, I’d like to be a part of what you’re doing,” because the answer is never going to be an easy yes.

And so I learned that there’s a difference between inclusion and integration, and being from the South, integration really means something, because what it means is, you’re not saying, “Hey, can I have a seat at the table,” you’re saying, “I’m going to take a seat, and these are the methods that I’m going to follow to make sure I get that seat.”

So at 42Phi ventures, what we do is we take founders like ShearShare, ShearShare came to us before they even had a product, they were an idea on a napkin. And when they approached us, the founders found me on LinkedIn, and chased me and said, “Hey, can you take a meeting with us, we hear about the work that you’re doing, and that you’ve been able to really help founders like us move the needle.” And I’ll tell you in three years, we’ve touched over 10,000 founders who have raised close to $1.5 billion in capital. And so we’re very proud of that work, because we’re working from the inside out, we’re not working from the outside in.

And so I learned that if we’re going to affect a change, and if we’re going to ensure that capital doesn’t just come at one point in the road, but it’s a complete flow downstream, that you have to, number one, tear down ignorance, tear down misunderstandings, be able to present examples of where founders who don’t look like the traditional founder are succeeding and are high growth. And so one by one, we’ve been able to do that, taking examples like ShearShare who in eight months, they went from being nowhere on a napkin to 350 cities around the globe.

And when you’re able to affect that type of change, you build credibility with other investors in the valley. So now at 42Phi, we have the privilege of being able to tap pretty much any VC firm in the valley and say, “Hey, we have this entrepreneur, or these founders who are building this amazing product, and we feel like you guys should be investing in them.” And they listen to us now, because we’ve proven through the work that we do, and the way in which we have taught founders, how to be excellent founders, because you can’t be on par with some of our counterparts, you have to be excellent, you have to be far and beyond. And so those relationships have fostered a lot of growth. And so out of that relationship, Eileen Lee, I don’t know if you guys know who Eileen is, a wonderful amazing human being.

So Eileen and I came to know each other some time ago. And so I follow what goes on in her portfolio and vice versa, and send deals to her and various things. And I was looking through her portfolio and saw this amazing company called Hone. And Eileen and I are kind of bouncing all over the place. So it’s hard to kind of sometimes track people down. So I sent her an email, and then I was like, you know what, we’re always trading messages on Twitter, I’m just going to tag her right now and say, “Look, I need to talk to you because I need to get to one of your founders.”

And so sure enough, we talked and she was like, “Who else, like Savina at Hone,” I said, “I must, must, must connect with this founder.” And I said, “Let me explain why I must connect with her, because I’m working with Living Cities, and we’re working on this initiative that centers around wealth creation, and how wealth is created and communities that otherwise either don’t have access, or don’t know how to be able to build certain wealth or know where the avenues are.” And I said, “What Savina is doing at Hone is so incredible, that it has the ability, this product in their work has the ability to forever shift the paradigm of how people of color and women grow their careers, how they move up the ladder, how they attain wealth, and then ultimately, the attaining of wealth through being able to work through an organization and move your way up opens even greater doors, if they decide to move out and become entrepreneurs.” So I said, “I must, must know Savina.”

And so Savina and I traded a couple of emails and then finally I got to chat with her and I was likE, “This person is so amazing. She’s dedicated her life, to ensuring that, whether you’re someone who’s coming in as an administrative assistant into a company, or if you’re a janitor, or a custodian in accompany her Hone works, to develop a career path for you to go wherever you want to go in your career.” And to me, thinking of my earlier jobs, I would have given anything, five years ago, to have something like Hone at my fingertips. And so, I know that was a perfect segue to Savina, and I want her to tell you guys, what they do, just how important their work is, and how impactful it is to both the San Francisco ecosystem, but to the work that Living Cities is doing as well.

Savina Perez: How do I follow that? Well, first of all, before I tell you a little more about Hone and my journey, I just want to thank these incredible women for really being able to blaze that trail, for myself and in my colleagues, it’s hard, when you’re going out for funding you’re trying to start a business, trying to grow it and get that access that everybody talks about. Opening those doors is not an easy thing to do. So these women are really blazing that trail for people like me, and thank you. Thank you.

So with regards to Hone it was really built out of personal challenge that I faced navigating my career, I spent about 16 years most of it in tech, I lead a growth at several venture backed organizations, building companies for other people that had either series A, B, C, D, so on and so forth. And trying to navigate moving up within those organizations. So going from an individual contributor, high potential employee, to a manager, director, so on and so forth, it took me years to understand how to navigate that, how to be able to learn how to manage down, but also manage up.

It wasn’t until I was about 16 years into my own career, I was a VP, 16 years before I had any type of formalized training, and coaching. And that’s pretty incredible when you think about all of those individuals that I had managed over the course of that career, 40, 50 or So folks, probably more, how much more effective could have had been earlier on had I had the access to some type of formalized training that could teach me how to do it well. So that was really the impetus for building a product like Hone that allows organizations to be able to quickly and easily source, manage and deliver high quality management and leadership development for the employees to be able to deliver it at scale at a low cost. So individuals not only at the top two or 3% of the organization to sea level on the VPs, but also those individuals that are high potentials earlier in the career, maybe mid level managers, those frontline managers, they’d have access to this type of training, and be able to move on or up throughout the organization over the course of their career.

So we found at Hone about two years ago, and I did it at the point where I had a wonderful family, I had a five year old at the time, and I decided to take the leap and leave my well paying job at the time, and I had an incredibly supportive partner and create this, create this company with really no formalized access to VC, as long as I had been in tech, I realized at that point that I didn’t have the network that I probably thought that I did. I wasn’t able to just reach out to all the VCs that we’ve heard of and say, “Hey, listen, I want to be able to take a meeting.”

So for some people where they might have to reach out to 10 or 15 venture capitalists to be able to get those meetings, I had to reach out to 75, 100 folks to even be able to get a seat at the table to be able to talk to them about what it is that we were working on. and what became apparent, not only did I not necessarily have access to the capital into the folks that kind of wielded that power, but I was actually learning how to pitch and potentially burning through those opportunities as I was going out there for capital to be able to build this company. And so that was definitely a challenge personally on this journey as I was building to be able to not only get the access, but be able to have access to folks that would be able to help me learn how to pitch, be able to be a sounding board during this process.

And so I think it’s, again, incredible what you guys are working on. And it’s something that I feel is absolutely necessary. And being able to open up, and change the dynamic of venture capital and entrepreneurship.

Elizabeth Reynoso: So Savina, folks who are here in the room who have heard Courtney and Tye’s story, what about that resonated for you when you were in front of some of these investors? And so that folks here in the room who might be in those roles, or have relationships there can understand what that impact is on you, and what they might be able to do to change those dynamics you’re talking about?

Savina Perez: Well, it definitely resonates because whenever I would walk into a well known VCs office, they would say, well, it’s nice to have a woman of color sitting at the table. And that was perplexing, I just never thought that somebody would actually say that to my face, quite frankly. It really was stunning. It was stunning to me, I’m a New Yorker, people say a lot of things to me in the street, but to me, it was a bit like the audacity, but I kind of had a grin through it and say, “Okay, we have to change the conversation.” And how people like me are perceived when they walk into this room, that it’s not an anomaly, it’s the norm.

So that being said, I think that with regards to ShearShare, and some of their challenges that they face when they were going through the fundraising journey, it’s not just about being able to get the access, as I mentioned earlier to venture capitalists, it’s about understanding how to navigate the conversation when you get that seat at the table, when you’re able to get into that room. Where do I start when somebody is literally telling you, “Well, I can’t believe you’re even here.” How do I navigate that conversation?

And so I think that, one of the things that I’ve had to learn within this process, is being able to handle those difficult conversations on the regular, but also being able to feel comfortable in pitching, how to do it, how to do it well, how to network, get out there, be comfortable in my own skin, understand that I am going to look a little different than everybody else in the room. And that’s okay, that’s a conversation starter, that’s going to be something that we can play with, we can work with in order to open the doors. So I think that what ShearShare went through I know, as well as myself, and just being able to get the doors to open. But once you get into the room, being able to navigate that room with confidence, it’s something that we’ve had to learn on the go, but perhaps it’s something that we could help other founders with, creating that community but providing the tools that entrepreneurs need in order to be successful.

Elizabeth Reynoso: TDs is part of your community, so it’s Monique, but talk about what that means to be really connecting founders to a community, because it’s a huge word, and everybody has their own definitions for it. But talk about some of the real community connections that are necessary for founders of color?

TD Lowe: So one of the things just on your definition of community, I grew up in a large family, that was like a community. And so community to me means family, it means the people that you go to when you are in need of help, or support. They are the people who when the world is loud, they can be a place of peace for you. They are a refuge. And so with founders of color, it’s sometimes really hard to find that place. And even with the work that Monique has done with building Black founders, it’s that community piece that builds a refuge where you know that you can go and you can let down your hair, so to speak, you can let your guard down and be really authentic about what your journey is, what you’re facing.

There’s a huge facade, if you will, that exists over the layer of entrepreneurialship. And that facade is that you must always portray that, I’m crushing it, I’m killing it, you’ll hear this, you go to a networking event, you’ll hear I’m crushing it, I’m killing it a million times before you exit the door.

Monique Woodard: That’s why I don’t go.

TD Lowe: And so every time I hear it, it’s like my eyes are like, “Yeah, okay. Yeah, you’re not crushing it and killing it.” But it’s the ecosystem that tells founders that they have to keep up this facade. And what community does is, it allows you to be in a safe space, where you can articulate through authenticity, that this is where I am, and the community helps you to grow. And so at 42Phi, that’s what we do. We have founders around the globe. And these founders are not your typical Silicon Valley types at all. And we take them under our wings, and we train them, we give them insider information, we equip them so that when they do sit down in front of that investor, the investors are blown away like, “Where did you come from? How did you get here? How did this even happen?”

And so we know that that is the power of family. I know we say community, but it’s the power of family that at any point, any of the founders that are in our community at 42Phi, if they need to talk to Courtney and Tye, guess what? They have direct access to Courtney and Tye, they have direct access to each other, and they share authentically their stories and help make introductions even among themselves. And so, I think that there’s nothing more important than community and the work that even Monique was, I guess I would call you the Trailblazer in building community. I’m catching her coattails.

Monique Woodard: So a lot of people ask me, what can I do to help underrepresented founders, what can I do to help women in the industry, what can I do, right? And there are two things that founders need. And really, it’s only two, everything else stems from that. It’s access to capital, money, and access to a network. Far too often, Black and Latino founders have very homogenous networks.

And then on the other side of the table, Silicon Valley, or just any VC, whether it’s Silicon Valley, or some other local venture fund, also have really homogeneous networks, right? And so I see so many times, people do these, oh, let’s get Black founders together. And it’s always corporate sponsored, and then they want to put the photo on Instagram, and like, see, we know, some Black people. That is actually not what founders need, founders need access to these networks that they can’t get into. I don’t need to go to a dinner and sit with Charles Hutton and Eric Moore, I have their phone numbers, if I want to go to dinner with them, I can call them, I need to get access to the VCs that I can’t get access to, to those networks.

So when you are creating programs and events, and all these things around community and around networking, really be intentional about providing those access points for people to not just be in their own network, but to jump across networks, right? And that’s really how you start to influence an ecosystem to be more inclusive, because you’re not just saying, okay, you stay in this lane, and then you will stay in this lane, you’re saying, let’s merge our lanes together, so that we’re both stronger. So that as a VC, my deal, flow is stronger. And as an entrepreneur, my access to venture capital as technical assistance, and all these other things are much stronger.

Elizabeth Reynoso: So Monique, tell us about working with New Orleans and Albuquerque. They are cities that Living Cities has worked with over time, and you’re hearing us talk about high growth entrepreneurs, we’ve been working in these communities already with leaders there who’ve been saying, “We want access to jobs, we want to create a thriving economy.” And they were doing it before with other employers. It was with startups, the upscale of SU cubed that we started to change the conversation, say, we don’t have to ask other people for these jobs, we can create them, we can create them as high growth founders themselves create the one million, $1 billion entrepreneur founder. What was that like for you to work with them, and what did you learn, and what do you think this audience needs to know about those other markets?

Monique Woodard: So, initially when we started talking about SU cubed to a few different people, they would ask, okay, well, why Albuquerque, and why New Orleans? And they sort of understood San Francisco, but they didn’t feel that those other two cities were ecosystems that were sort of on the rise. But if you look at their demographics, they’re incredibly important cities to have a foothold in and to understand. Albuquerque for instance, to New Mexico. And New Mexico is one of the first states to have a new majority, where people of color are the majority in that State, and white people are actually the minority. And so if you can figure out how to build an inclusive business and entrepreneurship ecosystem in a new majority State, you can understand what is coming on the horizon when America becomes a new majority nation. So that was really important for us to understand Albuquerque.

And in particular, New Orleans is I think, it’s 52% Latino, and 20% Native/Indigenous people. So those are two really important communities for us to understand. And then if you moved to New Orleans, New Orleans is a majority Black city, 60% Black. But where companies owned by Black entrepreneurs, do not get a majority of the business receipts, right? And there is this emerging ecosystem of entrepreneurship, incubators, accelerators, local venture funds, individual angel investors, but where Black entrepreneurs are not well represented in that fold. So out of the $40 million in angel investments, Black entrepreneurs in New Orleans got 1.3 million in a city that is majority Black. That’s crazy.

So it’s really important for us to kind of take these cities and sort of break them apart and understand why that is. The obvious answer is there’s bias in the system, right? But rather than just saying, okay, there’s bias, and then we go on from there, it’s okay, well, how do we break those things down. And in New Orleans, the New Orleans Business Association, Lynette is here, as we mentioned, was already doing a lot of this work, and was already focusing on entrepreneurship.

I think what SU cubed was able to bring in was saying, let’s focus on high growth entrepreneurship, because high growth companies are the ones that change cities economies, that create jobs, not just one or two jobs in a small business, but create dozens of jobs to hundreds of jobs in an anchor institution, and those anchor institutions, then we get new entrepreneurs and new founders, just like founders spin out of Uber, and Airbnb, and Salesforce, they can then spin out of those anchor institutions in that city, and they’ll also spin out angel investors in those cities.”

So we really want it to take ecosystems that had the racial makeup that we were looking to figure out, and also had some unique challenges. And just to touch on San Francisco, San Francisco, it’s obviously where people look to for innovation, right? San Francisco is part of Silicon Valley, and you have silicon beach, and Silicon alley, and silicon plains, and slopes. But what Silicon Valley hasn’t been able to do is to figure out how to give Black and Latino entrepreneurs an equitable seat at the table, right alongside other entrepreneurs that they’ve been so great at fostering. And so, San Francisco and Silicon Valley were really important for us to figure out as well.

Elizabeth Reynoso: So I’m going to ask Monique one more question, and then we want to open it up to all of you and bring you in the conversation. So you’ve been on both sides, as a founder, and now as an investor. And even on the investor side-

Monique Woodard: Don’t ask me which one is better, or harder.

Elizabeth Reynoso: I won’t, but talk about the challenges of raising a fund. You’re running Cake Ventures now, what’s that like?

Monique Woodard: So, I think I wrote on Twitter several months ago, that raising a fund is like crawling through glass, raising a fund as a woman is like crawling through glass with no clothes on, raising a fund, as a Black woman is like crawling through glass with no clothes on and cover us in honey and put a bunch of bees in the room, right? And so it’s incredibly difficult, the same difficulties that Black entrepreneurs have raising capital can be seen on the other side with Black VCs, raising capital to deploy into companies.

Elizabeth Reynoso: Like, ShearShare just said, right? Their first steps.

Monique Woodard: I mean, look, I remember about a year ago, I walked into a room to pitch a well known fund to funds on the east coast. And it’s actually an LP that I really like. And I went through my pitch, my spiel and told him what I’m investing in. And he said, “Look, you’re like one of the only experienced Black women, entrepreneur, Black women VCs, why don’t you just go to some Sand Hill Road firm and make a bunch of money?” And on that day I was like, “I don’t know.” I was like, “You are right.”

I don’t have a good answer today, because it is incredibly difficult. And people like Charles Hudson and Eric Moore and Marlon Nichols, and myself are well experienced in this industry. And it still takes us exponentially longer to raise capital, and we raise less capital than our peers. And so I don’t have a good answer for that, but it is definitely related to the challenges for entrepreneurs of color and women entrepreneurs, if you are a woman trying to raise, Black woman in particular, trying to raise a fund.

Elizabeth Reynoso: Thank you. All right. I know you have questions for this amazing panel. Come on up to the mic or Joanne will help you with a mic. There’s someone behind you.

Laurie Bamberger: Okay, thank you. I just want to thank you so much for this incredible panel. My name is Laurie Bamberger, and I’m with a new organization called the Economic Equity Network, it’s about opportunity zones and trying to develop a network of investors, entrepreneurs, professionals, lawyers, accountants of color and women to lead the re envisioning of how we can bring capital to our under invested communities that are now called opportunity zones. And one of the things that strikes me, so I’ve been in the world of community development my whole life, except for a three year blip when I founded a dot com, and went through these access to capital issues that all of you talked about, and was supported by a community for women entrepreneurs, or I wouldn’t have made it anywhere, even though those three years would have been condensed three months.

But I guess I want to encourage the venture and angel community in thinking about how to support entrepreneurs of color, and longtime business owners of color who might want to scale their companies because there’s even less access to capital for those, especially in these 8700 zip codes, to think about opportunity zones. The biggest complication is that it requires a 10 year patient equity investment and 10 years as we know, isn’t really the venture capital horizon or tolerance for investment, but it might be on the angel and seed side.

So I’m working both on developing this network of people to lead the visioning, but also the network of people to figure out how we can fill some of these gaps in financing for small businesses to scale in opportunity zones. And I’d welcome increasing the conversation. The question is, would you ever consider a 10 year investment? And is there a way to make it work with at least partners on the seed stage, so we can bring this $150 billion worth of capital that’s out there to invest in Black entrepreneurs and other entrepreneurs of color in these communities?

Monique Woodard: Yep, got it. Okay, so here’s what I think about opportunity zones. Super important, the right people are not involved in a lot of these opportunity zones, right? You’re seeing it be very lots of real estate funds, lots of white LED real estate funds, not actually led by the people who it’s actually impacting. That’s one thing that needs to get fixed. However, I think, expecting venture capital to go in and at large scale, participating in opportunity zones, is a mismatch of the capital type, right? And I think so often people expect venture capital because that’s the type of capital that they know to do all the things, right?

And venture capital actually does this very specific thing for what is actually a very small number of people in businesses. And there are now opportunity’s owned funds that are now looking at the opportunity’s own opportunity. But I think that venture funds are unlikely for now to play in that space at scale, given the requirements and structure of opportunity zones, so I kinda want to disabuse you of the thought that venture capital is going to come in and make everything great.

I think some of the things that we’ve been able to do at SU cubed is to say, look, founders need capital, let’s figure out new capital models that match to the type of capital that they need. It’s not necessarily going to be venture capital, it may be credit union backed, CDFI backed, it might be some other sort of capital, it might be actually connecting people to contracts as opposed to equity based funding. It’s lots of different things, and I think that we have to start to sort of step away from venture. So thinking about everything has to be solved by venture capital, because you see venture capital has gotten itself involved in a lot of businesses that it shouldn’t be involved in. And now we’re looking at it like, “Why’d you invest in that business?” And you’re like, “Well, that’s because y’all wanted us to,” and it’s just not necessarily the right model.

Laurie Bamberger: I appreciate that, the reason we’re looking to venture but we’re really not, and the reason private equity is that the law requires that the investment be an equity investment, and not a debt or other form of capital. And of course we can broaden the capital stack in these deals, but that was really the point, it’s a problem within the law and the regulation, the type of capital allowed to be invested.

Elizabeth Reynoso: Thanks, Laurie. Others here.

Laurie Harris: I am Laurie Harris. I am portfolio manager for the Real People’s Fund. And we actually are a microlender as well as the next stage of financing for primarily focused on Black and brown entrepreneurs, women-led businesses in Alameda Contra Costa. So have a long history and micro lending, and particularly focus now and concerned about its beyond capital, just as you said, the technical, what we call traditionally technical assistance, but also recognizing the need to really build out the advisory community that supports entrepreneurs and what I’ve found so interesting here as well, I’m really focused on, Okay, I need bookkeeping services and I need technology services, I need digital marketing services for my entrepreneurs in order to get them to the high growth stage. What I also really need is this component of, yes there’s pitch prep available, but that networking in the room and that higher level advisory capacity and the peer to peer confidence building for my entrepreneurs is really something that you really highlighted for me an elevator for me is something to bring to bear. So can you describe what that looks like, and how you built that out?

TD Lowe: Sure. So it started small, locally, if you will. And it started with working with event organizations around Silicon Valley, who to Monique’s point, have these sort of siloed groups who don’t ever interchange or interact with each other. So it started there, with us gaining influence inside of these individual groups, and then saying, you know what? You have something that’s good, they have something that’s good, but collectively, founders need this, to get from point A to point B. I have five other partners at 42Phi, so I’m not the only one. And we all have different levels of expertise that are complementary in every category to get a founder from point A to point Z, if you will.

And so the essentials, if you will, of getting the information, the support, because if you just need information, there are several sites that I could send you to that you could go read a whole lot of things. But it doesn’t translate the same way when you have someone who has navigated the ecosystem, who can sit with you one on one, and say, “Okay, I understand your unique set of problems, I know where you are as a founder, and I understand that you have a great idea, but you don’t have the technical resources.” At 42Phi, we can plug in that technical resource. If we talk to you, and we realize, oh you have a great set of engineers, but no business acumen whatsoever on your team, then we can bring in business strategists who will sit down with you, and work alongside your team to make sure that from a business perspective, you’re doing what’s necessary to get that technology into the hands of your users.

Whether it’s the external market, even knowing that you exist, we do that same thing of plugging in a lot of digital marketing resources, and consumer knowledge about how to get that product to market and making sure that your target demographic actually knows that you’re out there. And so the reason that we were in eight months able to steer ShearShare from zero to 350 cities, is because there’s something that we understand internally about how to do those things, do them succinctly, and it’s rinse and repeat. And so it’s very hands on, it’s not, I’m going to send you to a bunch of things and read. And it doesn’t just rely on us, it relies as partners, we have the community of the founders who we’ve worked with over the past three years who are now an extension of our work that continue to provide that support to others in our ecosystem.

Laurie Harris: How important is it for entrepreneurs to have people that look like them in-order to have these conversations about giving up private information and being vulnerable?

TD Lowe: Absolutely. One of the things that we tell even the VC firms in our network that we work with, is that when a founder comes and sits down and talks to you, even after you’ve invested in them, and you’re getting a State in a checkup on where they are and what’s going on, you’re still not getting the truth, we get the truth. And it’s because we build a rapport with founders, that they know that they’re coming into a place where we’re going to operate with integrity, we are going to respect their privacy and their information.

That’s why if you go and Google us, you will never see us showcasing and advertising our entrepreneurs for two reasons. Number one, we want entrepreneurs to know that they can come to us regardless of what stage they’re in, and not raise a flag with their investors, their current investors who say, oh my gosh, okay, so you had to go there for help, maybe things are really bad. And then the other thing too is, we do our best to not trample our entrepreneur stories. I’m not saying that the work that we do is not important, but that entrepreneur narrative is the thing that’s going to drive and create other entrepreneurs. So we do our best to stay out of the way, and kind of be like the whiz behind the curtain, helping entrepreneurs grow and look fabulous.

Monique Woodard: And I just want to sort of piggyback off something you said, it’s not just about hearing the truth. It’s also about telling the truth, because so often entrepreneurs are not getting the truth in these meetings, especially underrepresented entrepreneurs, and women entrepreneurs. And so I’ve sat down with entrepreneurs, and they tell me what they’re building. And I kind of say, “Okay, well, what are other investors saying,” he’s like, “Oh, they love it, and they think, blah, blah, blah.” All right, I’m going to tell you what they’re not telling you.

TD Lowe: Right, what they’re really saying.

Monique Woodard: Here’s what the truth is, right? And so it’s really all about helping entrepreneurs get to the truth, and then be able to use that to be so much better than they were before, right? And so that’s what you kind of have to be, you have to be the translator of everybody’s lying to everybody, basically it’s what I’m telling you, right? So how do you get them so close to the truth that they can be better for it?

Elizabeth Reynoso: Thank you Monique. What you said to TD about the rinse and repeat, it’s not about having the events, although you might start out that way in your ecosystems, right? Having more events, but it’s about making the invisible, visible, letting the stories come out. So final words from all of you for the SOCAP audience as we close off?

Audience Member: I want to say how much I appreciate the four of you being up there, and being very clear about the high net worth ideas, because I think a lot of times we think small because we’re afraid to think big. And it just clicked for me, so I appreciate that. My question for you is, with that in mind, how do you synthesize, if we feel we’ve got that moment, how do you synthesize all of the ideas and requests for your time, and determine which one you get back to?

Elizabeth Reynoso: You don’t sleep, I know you don’t.

TD Lowe: No. Okay. So I’ll be honest. And the last five years, I probably get between three or four hours of sleep a night. But let me explain to you why, because we have founders around the globe. Our founders are not just in the US, we have a portfolio company in India that’s making so much money that investors are chasing them. And they’re like, we don’t want your money, because they’re so cash flow positive. But we have founders all over the globe. But when you’re passionate about doing something, then the time doesn’t feel like the time, if you will. And one thing I want to kind of piggyback on what you were saying about the transparency and the truth that is just, I cannot resonate or echo that enough, I think it is the greatest folly, if you will, in the entrepreneur ecosystem, is that people can’t, they feel like they can’t tell the truth. They can’t say, “I don’t know,” on both sides of the table.

I mean, I’ve sat with investors of other firms who are listening to other entrepreneurs pitch, and I know they don’t have a clue what these entrepreneurs are saying. And they’ll say, “Yeah, yeah, that’s really great.” And I’m like, “You don’t know anything that they just said.” And so I think that what communities do and what SU cubed is doing is bringing a level of transparency and authenticity to the journey of what we’re doing to connect founders, entrepreneurs, high growth founders and entrepreneurs, to the tools, networks, resources, capital, etc, that’s needed to move to success.

Monique Woodard: And I just want to say really quickly, that unlike TD, I get sleep. I do not let other people’s to do lists become my to do lists. So I give as much as I can, but I’m going to go to sleep. And I want to get the final word Savina, the entrepreneur in the room, please.

Savina Perez: We spoke a lot about communities and access. And as an entrepreneur, as a founder, one of the biggest challenges that we face is awareness and understanding what is actually out there for us to be able to tap into. And so I will say as you’re building out these communities and creating events and doing these wonderful things in order to grow the opportunities that are out there, especially for underrepresented individuals, understand that there’s this element of awareness that we need to invest in. We need to be able to push it out there so that individuals and various communities, they know what they have available, what’s at their fingertips, if there’s an event here or there’s a community there, they understand that it’s available, it’s available to them. So as much as we want to tap into, okay, we want to create access, we’re creating communities, etc. Awareness is a huge component, and we need to be focused on that as well.

Elizabeth Reynoso: So everybody, please join me in thanking Savina Perez, TD Lowe and Monique Woodard. Will be here if you want to come and ask us questions afterwards, and to learn more about what’s going on in Albuquerque and New Orleans. You got New Orleans represented right here and you can come up and talk to us about Albuquerque. Thank you. See you the rest of the day.