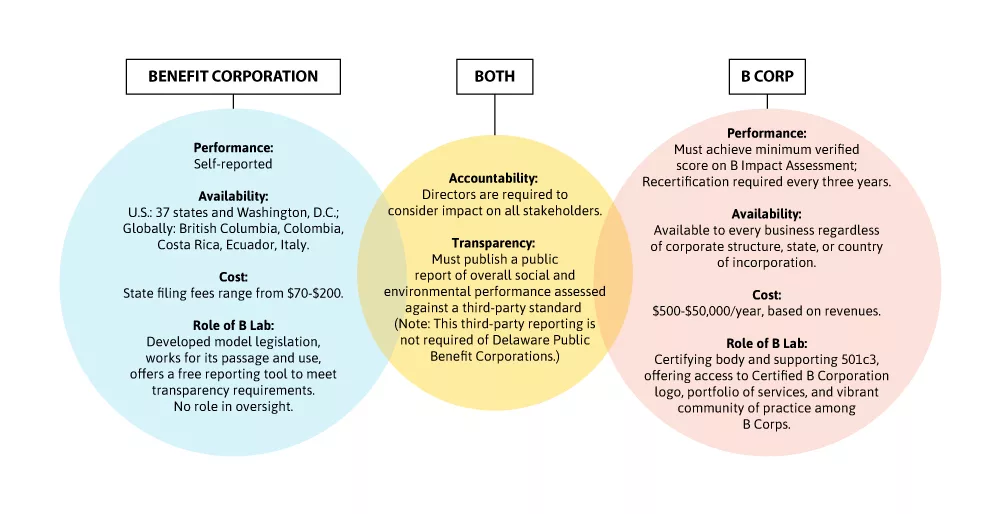

Many people use the terms “B Corp” and “Benefit Corporation” interchangeably. While similar in concept, there are important differences. B Corp (short for Certified B Corporation) is the term used for any for-profit entity that is certified by the nonprofit B Lab as voluntarily meeting higher standards of transparency, accountability, and performance. Think of it as the Good Housekeeping Seal of Approval for businesses voluntarily trying to do well by doing good. By contrast, a Benefit Corporation is a type of corporation currently recognized in 37 states with legally protected requirements of higher purpose, accountability, and transparency.

WHAT IS A B CORP?

Any for-profit entity can be a B Corp provided it is certified by B Lab, the nonprofit that oversees certification, and pays the applicable membership fee. My law firm, Hanson Bridgett LLP, is a founding B Corp but is not a corporation at all; rather, it is a limited liability partnership (LLP). It became a B Corp by passing the B Impact Assessment, which analyzes the operations of an organization as a whole and provides a score based on how the business conducts its operations. The assessment analyzes many things about the business’ operations, including, for example, the quality of its products and services, its treatment of workers and the environment, and if and how the business supports its community. Passing the assessment test requires a score of at least 80 out of 200 points. The idea behind being a B Corp is to do well by doing good, but also to measure what matters and to report on it.

B Corps pay membership fees based on their annual revenues. These membership fees go to support the nonprofit activities of B Lab, including its ongoing work to continually improve the comprehensive assessment tool and the third-party auditing services necessary to certify and recertify B Corps every three years.

In return for membership fees, B Corps receive various membership benefits. One of the most important is being part of a community of B Corps and part of a movement dedicated to creating a more just and conscious economy that works for all. B Corps are now located in more than 70 countries, have various gatherings around the world including an annual retreat, provide opportunities to support each other’s businesses, and impact policy and legislation throughout the country and around the world. Fellow B Corps support each other as a community and support each other financially by referring business to one another. B Corp certification is voluntary and can be changed at any time by the owners of the business. The B Corp movement has been lauded by Bill Clinton, Robert Reich, and David Brooks, among others.

WHAT IS A BENEFIT CORPORATION?

By contrast, the Benefit Corporation is a type of corporate governance. The Benefit Corporation actually sprang out of the B Corp movement. It arose because many entrepreneurs felt that the B Corp certification could not provide the kind of legal protection that a government recognized legal form could provide. Unlike a B Corp, which can be any type of for-profit legal entity, a Benefit Corporation is a type of corporation. There are many reasons for this that are too long to go into in this article, but suffice it to say that the Benefit Corporation was created to build the B Corp mission into the DNA of the corporation.

Let’s go into a bit of detail: A Benefit Corporation is a for-profit corporation, but in addition to creating value for its shareholders, it has three additional legal attributes: 1) accountability, 2) transparency, and 3) purpose.

ACCOUNTABILITY

Like a B Corp, a Benefit Corporation must consider the impacts of any action on not only its shareholders, but also on its employees, its customers, the community, the environment, the short or long-term interests of the corporation, and the ability of the corporation to accomplish its public benefit purpose.

A Benefit Corporation must assess its overall social and environmental performance on a yearly basis using an independent third-party standard, many of which are free to the public, such as the B Impact Assessment mentioned earlier. The standard must be developed by an entity that has no material financial relationship with the corporation, and the standard’s criteria and development process must be publicly available. In addition, the amount and sources of financial support for the entity developing the standard must be publicly disclosed, along with any relationships that could reasonably be considered to present a potential conflict of interest. The purpose of these requirements is to prevent the corporation from using an assessment tool that is self-serving. Unlike a B Corp, however, a Benefit Corporation is free to use any assessment tool that meets the criteria noted above, including the B Impact Assessment, but is not required to use the B Impact Assessment tool. A Benefit Corporation is also NOT audited by a third party like a B Corp is, though a Benefit Corporation could be both a Benefit Corporation AND be certified as a B Corp by B Lab.

TRANSPARENCY

A Benefit Corporation must report its overall social and environmental performance to its shareholders and the public in an annual benefit report. The report must describe the third-party standard selection process, the ways in which the Benefit Corporation pursued any general or specific public benefit during the year, and any circumstances that hindered the creation of the public benefit. By contrast, a B Corp is not required by law to create such a report, though it is encouraged to do so. If a Benefit Corporation fails to pursue its public benefit purpose or issue the benefit report, its shareholders may bring an action in court to force the corporation to do so in order to ensure transparent operations. There is no court action for failing to meet B Lab’s standards for B Corps, though a B Corp could lose its certification if any audit irregularities are not corrected.

PURPOSE

Benefit Corporation status fundamentally changes how a company is permitted to act. In addition to creating shareholder value like other for-profit companies, a Benefit Corporation must provide a general public benefit — namely, a material positive impact on society and the environment as a whole. Specific examples include providing low-income individuals or communities with beneficial products or services, preserving the environment, promoting economic opportunity, and improving health in the community.

Often I am asked if B Corps and Benefit Corporations can attract capital. For example, Lemonade, an innovative insurance broker backed by SoftBank, Sequoia and other venture capital funds, completed the most successful IPO of 2020, raising 139% on its first day of trading (after pricing above the underwriters’ range). Vital Farms, which markets pasture-raised eggs and butter, followed suit in 2020 with an IPO earning a market cap of $1.3 billion at close while receiving a valuation of $136 million just two years earlier. B Corps and Benefit Corporations represent a new breed of conscious capitalism, combining higher purpose, accountability, and transparency where there’s no trade-off between return on investment and social impact.

Jonathan Storper co-chaired the legal working group that drafted benefit corporation legislation in California and is a partner at the law firm of Hanson Bridgett LLP in San Francisco, where he works with mission-driven businesses.

Note: This article was originally published on April 4, 2015, and updated by SOCAP Global on April 7, 2021.