While talent is equally distributed by race, gender, and sexual orientation, access to capital is not. This creates an excellent investment opportunity, a potential competitive advantage in identifying and funding talent, ideas, experience, and knowledge that the majority of the venture capital community has discounted and overlooked. Let’s take a look at the factors that contribute to this opportunity.

NON-WHITE TALENT IS DISPROPORTIONATELY OVERLOOKED

There is an enormous racial disparity in who is receiving venture capital, the fire-starter of our economy. According to ProjectDiane2018, a biennial demographic study authored by digitalundivided, Black-women–led startups have raised 0.0006 percent of the $424.7 billion in total tech-venture funding raised since 2009. But Black women today comprise the fastest-growing group of entrepreneurs in the US, with over 1.5 million businesses — a 322 percent increase since 1997. These businesses generate over $44 billion a year in revenue. There is a similar disparity regarding gender. Out of the $60 billion that venture capitalists invested in 2017, $1.5 billion went to women-run companies, which is roughly 2 percent of all venture capital invested last year. Studies show that women CEOs in the Fortune 1000 drive three times the returns of S&P 500 enterprises run predominantly by men.

RACIAL EQUITY = RETURN ON EQUITY

Global management consulting firm McKinsey assembled a report, “Diversity Matters,” which included a dataset of more than 1,000 companies and measured the effect of ethnic and racial diversity on profitability (in terms of earnings before interest and taxes, or EBIT). Here are the findings:

Companies in the top quartile for racial and ethnic diversity are 35 percent more likely to have financial returns above their respective national industry medians. More simply: diverse companies outperform their non-diverse counterparts and competitors.

Companies in the bottom quartile for the category of gender and the category of ethnicity and race are statistically less likely to achieve above-average financial returns than the average companies in the dataset. More simply: non-diverse companies are lagging rather than merely not leading like their diverse counterparts.

The unequal performance of companies in the same industry implies that diversity is a competitive differentiator shifting market share toward more diverse companies.

The data show a linear relationship between racial and ethnic diversity and better financial performance: for every 10 percent increase in racial and ethnic diversity on the senior-executive team, EBIT rises 0.8 percent.

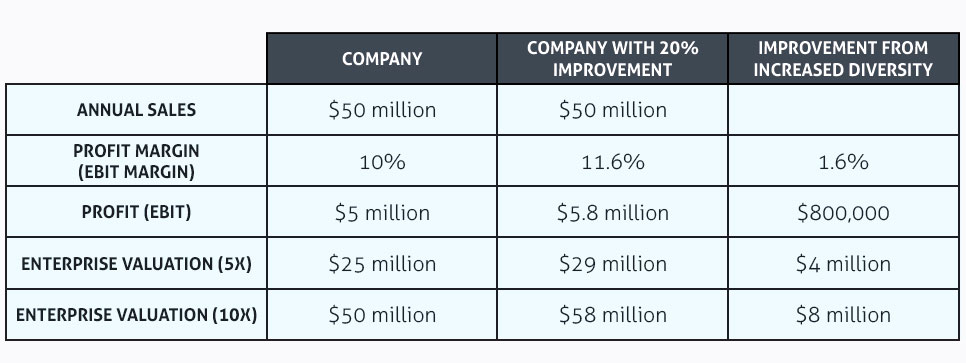

While all of these findings are profound, the last finding — a mathematical correlation — has astounding financial implications. The table above illustrates an example of a company that has $50 million in annual revenue and a 10 percent profit margin (or EBIT margin). Based on McKinsey’s study, if the company’s racial and ethnic diversity increased from 20 percent to 40 percent, its EBIT margin would go from 10 percent to 11.6 percent. Its profit would go from $5 million to $5.8 million — an $800,000 improvement.

Let’s take a look at how this improvement in diversity affects valuation. A company’s valuation can be estimated using a multiple of EBIT. Depending on a number of factors, including sales, profit margins, industry, and growth rates, a company’s valuation estimate can range from 5 times EBIT to 10 times EBIT. Both scenarios are shown above. In the 5x scenario, the company’s valuation improves $4 million, from $25 million to $29 million. In the 10x scenario, the company’s valuation improves $8 million, from $50 million to $58 million. What investor, owner, or CEO would not take notice if they were told they could improve their company’s valuation by $8 million?

A growing number of investors are asking the question, “What great founder is not being funded?” This inquiry is leading them to great possibilities in their financial returns by identifying untapped genius — namely non-White, non-male entrepreneurs — who haven’t had access to the fuel needed to bring about untold innovation. These stories of racial equity driving return on equity will eventually change the investing status quo. As an investment community we will come to the natural conclusion that also rings true in biology: any system that is predominantly homogenous is vulnerable, while more diversity optimizes and makes the system more resilient. Resilient organizations and investments will both outlast and outperform their peers. As a fiduciary, I can promise you, this is the smartest money there is.

Interested in continuing the conversation on racial equity? Make sure to attend SPECTRUM, the premier gathering of multicultural changemakers creating an inclusive impact economy, June 12-13, 2019 at The Gathering Spot in Atlanta, GA.