A SOCAP Guest Post By Patrick Briaud, Philanthropic Advisor, Rockefeller Philanthropy Advisors

With increased attention from institutional capital, impact investing still needs philanthropy to play critical roles as both investor and field builder.

All Sources of Capital are Not the Same

Impact investing has the attention of institutional investors – driven largely by client demand. Over the last three years, BlackRock, Goldman Sachs, Bain Capital, and TPG are just a few who have made significant moves towards integrating impact investing into their asset management offerings. Across the financial industry, the number of SRI (socially responsible investing) mutual funds and ETFs has grown rapidly. MSCI and Morningstar – leading providers of independent investment research – have also released ESG indices and ratings to inform investment decisions.

On the whole, this is a good thing.

It means more attention, more resources, and more integration into investment management practices, which drive $300T in global capital markets. If only 1% of that money moves towards impact, the U.N. Sustainable Development Goals could be fully funded (citation).

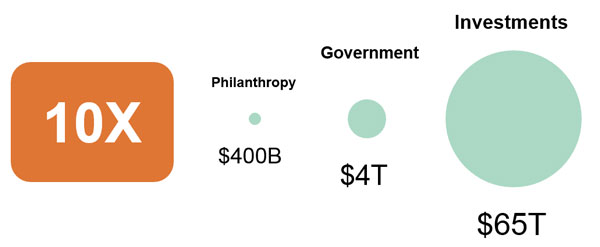

In the US, the excitement of institutional involvement has good reason. There is an order of magnitude difference between potential sources of impact capital: philanthropy ($390 billion)(citation), government ($3.8 trillion)(citation), and investments ($65 trillion)(citation).

Sources of Impact Capital

So, let’s tell all the foundation folks to start looking for Goldman jobs, right? Well, no.

So, let’s tell all the foundation folks to start looking for Goldman jobs, right? Well, no.

As with any opportunity, there are risks. One key risk is the effect of traditional investment priorities overshadowing those of traditional impact dollars, a.k.a. philanthropy.

Impact. Investing. Half of the name is what professional philanthropy has been doing for over a century and impact investing will do well to take note. (To be clear, philanthropy also has much to learn from business and traditional investing: market-based approaches, operational efficiencies, data & research, innovation, etc.)

There are four ways philanthropy plays a critical, unique role in impact investing.

1. As investment dollars.

While philanthropy may not be able to run a sophisticated discounted cash flow valuation or know how to pursue top quartile venture returns, it does have completely risk-free capital to deploy … every grant is a guaranteed 100% financial loss. What results from an investor’s benchmark or comparable universe at -100%? Freedom. Freedom to pursue uncertainty, to have a long time horizon, and to go where other money might not go. In other words, philanthropy can be risk capital, patient capital, or early capital in order to prove models and seed companies for institutional money to follow.

One example is the Catalyst Fund, which annually seeds and mentors 20 innovative fintech startups that promise to shape the future of global financial inclusion. With philanthropic dollars, the Gates Foundation and JPMorgan Chase are seizing an opportunity to develop a cohort of promising business.

Source: Catalyst Fund

2. As infrastructure builders.

Philanthropy continues building critical impact investing infrastructure: associations, benchmarks, market-mechanisms, regulation, and research.

For example, impact investing practitioners across the impact/return spectrum are better informed and empowered because of associations like Confluence Philanthropy, GIIN, Mission Investor’s Exchange, TONIIC, UN PRI, and many others. While member dues play a role, philanthropic dollars empower these associations to provide key services, convenings, and tools.

The Case Foundation, for example, has recently made significant field-building investments. It has developed a primer guide, helped inform narrative analytics on how the field is perceived, and is now focused on a network map using transaction data to highlight investment activity and trends.

Though promising at this point, who knows how helpful or successful this effort will be; but it is these kinds of collaborative sector-building experiments that lead to industry scale and support.

Though promising at this point, who knows how helpful or successful this effort will be; but it is these kinds of collaborative sector-building experiments that lead to industry scale and support.

3. As impact translators.

For over a century, philanthropy has been in the business of impact evaluation. While impact is a worldview decision (i.e., driven by a particular lens on the world) and while philanthropy has no competitive forces to ultimately agree upon or optimize social impact, significant progress have been made towards what works and what doesn’t. Impact investors have much to learn.

Many of the questions that philanthropy has grappled with can be applied to impact investing. For example, “What is your goal in measuring impact?” The answer could be to simply keep the investee accountable, to help make future investment decisions, or to prove a concept.

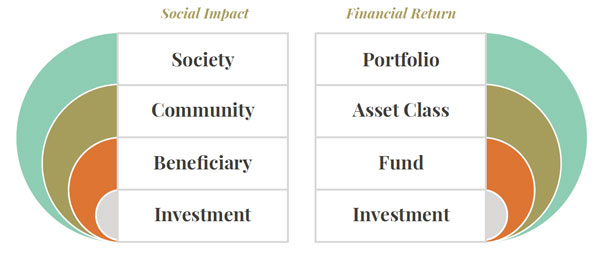

Philanthropy also knows well the challenges and resource requirements for impact assessment at different levels – from the most tactical deal level to the broadest societal change. This diagram shows how the layers of impact measurement can be applied to both social and financial return.

Levels of Assessment

Source: Rockefeller Philanthropy Advisors

In addition to helping with measurement, philanthropy can also serve as impact translator. A thoughtful philanthropic advisor, for example, can sit down with a donor/investor and her investment professional in order to interpret impact goals in light of investment priorities.

Another important nuance is impact risk. A common framework to judge the viability of a traditional investment is the balance between risk and financial return. Within impact investing, that risk applies not only to financial return, but also to social return. For example, an efficient cold storage delivery system for vaccines to rural communities might have high social impact potential, yet carries high impact risk should the new approach fail.

4. As thoughtful educators.

Philanthropy can serve as educator through thought leadership, convenings, and training. This can take the form of leading content creation, facilitating seminars with interested investors and advisors, planning thoughtful gatherings and conferences, and conducting interviews to give realistic voice to experienced practitioners.

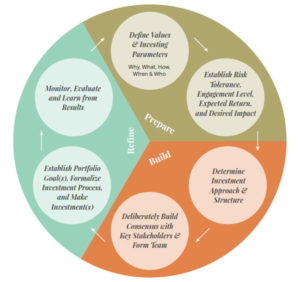

The Gates Foundation and Rockefeller Philanthropy Advisors see an important, timely gap between broad impact investing awareness (e.g., institutional capital interest and news coverage) and the ability to implement. To that end, we just completed both a refreshed introductory guide as well as an implementation guide – helping interested parties navigate the following implementation cycle.

Impact Investing Implementation Cycle

Let’s do this

So, whether you sit at Bloomberg Philanthropies or at a Bloomberg terminal, let’s keep learning and pushing each other towards impact investing excellence.

Patrick Briaud leads RPA’s impact investing services – helping individuals, families and foundations integrate their financial and social impact goals. He is a frequent speaker at investing, philanthropy, and impact investing convenings. Patrick’s background includes investment management and professional tennis.

Patrick Briaud leads RPA’s impact investing services – helping individuals, families and foundations integrate their financial and social impact goals. He is a frequent speaker at investing, philanthropy, and impact investing convenings. Patrick’s background includes investment management and professional tennis.