A SOCAP Guest Post by Jayanth Kashyap

For the past two decades and more, global financial institutions and economic organizations such as the Organization for Economic Co-operation and Development (OECD), World Bank, International Finance Corporation (IFC) and Asian Development Bank (ADB) have emphasized the significance of small- and medium-sized enterprises (SMEs), especially in developing regions. An updated 2017 assessment of the formal SME financing gap by IFC indicates an unmet US$4.5T need (US$2T in 2010) in emerging markets – required for about 9M enterprises or 44% of formal small and medium businesses. This is roughly about 1.3 times the current supply of US$3.5T of finance being provided to these enterprises. These figures are staggering.

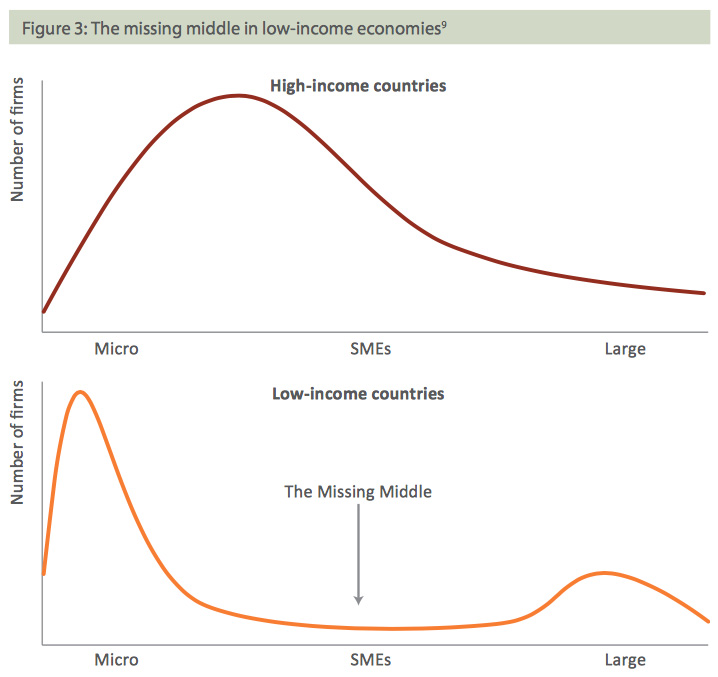

Laurie Spengler, CEO of Enclude, led a panel discussion at SOCAP17 in a session titled SME Financing: Why Are We Making Such Little Progress? Panelists Sam Parker (Director, Shell Foundation), Shalaka Joshi (Gender Lead, IFC South Asia), Marnix Mulder (Director Market Development, Triple Jump), and Philip Varnum (CFO, The Lemelson Foundation) shared their perspectives on why the complex SME engine needs more than just rocket fuel to drive growth. SMEs requiring capital between US$100K to US$2M are commonly grouped in the “missing middle” funding segment – too large for microfinance and informal investors and too small or risky for commercial banks and private equity funds.

The “Missing Middle” Symbiotics Group

The “Missing Middle” Symbiotics Group

Complex Barriers to SME Financing

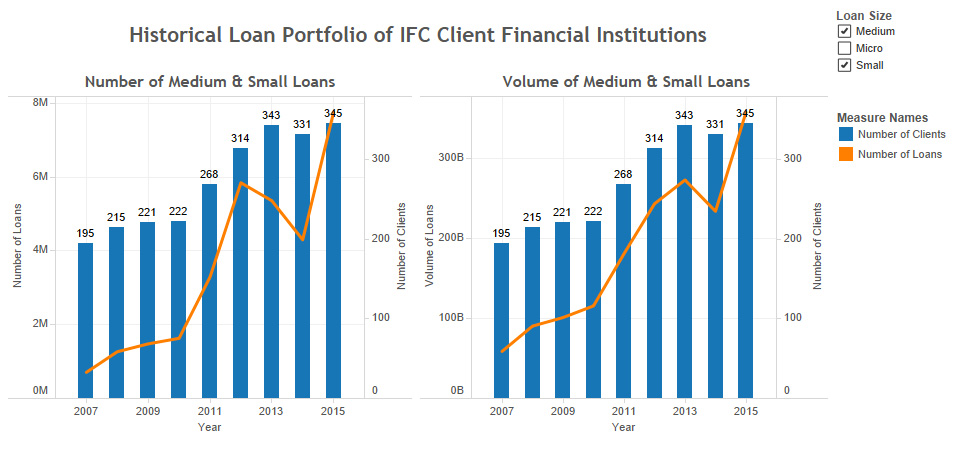

“The challenge with SME financing is that it is NOT a homogenous market – there are several sub-segments, but the lack of segmentation or specificity is an issue” noted session panelist Marnix Mulder. This is perhaps the truth behind the barriers in funding SMEs. A recent study by the European Investment Fund (EIF) on European SME financing patterns classifies SMEs based on firm, product, industry and country characteristics. Examples of the clusters include mixed-financed SMEs, state-subsidised SMEs, debt-financed SMEs and trade-financed SMEs. Lack of access to finance remains a top barrier to SME financing and Shalaka Joshi elaborated that IFC is working to close the SME financing gap by partnering with many types of financial intermediaries, including microfinance institutions (MFIs), commercial banks, private equity firms and leasing companies. IFC’s latest reach data indicates partnership with over 300 financial institutions across 90 countries. Creating more lines of credit through such partnerships could potentially address the needs of several clusters of SME financing.

Source: SME Finance Forum

Source: SME Finance Forum

“SME financing is a tough business to make returns” remarked panelist Sam Parker. Making SME financing commercially attractive remains a conundrum. The Shell Foundation has been an active player in this segment via GroFin, the SME business loan company it co-founded in 2004. GroFin provides a combination of mezzanine finance and specialized business support to drive growth of small and medium businesses across Africa and the Middle East. With over US$500M under management, GroFin’s 2016 impact results indicate over US$700M of economic value added by its 600 investees serving over 5M low-income consumers. The company also claims to have created more than 18,000 jobs and sustained more than 95,000 jobs.

Local banks typically shy away from lending to SMEs due to several reasons – lack of collateral, poor accounting records, track record and from the entrepreneur’s side, there is a general lack of financial literacy in accessing capital. A World Bank report shows that a high proportion of financially constrained SMEs actually refrain from applying for credit – about 28% of SMEs in middle-income countries and 44% of SMEs in low-income countries. As indicated earlier, some SMEs exclude themselves because they lack profitable projects, others perceive that their application will fail because of an inability to provide all required information or lack of collateral. But the panel indicated that lenders cannot circumvent banks in emerging markets. Capital markets tailored specifically for SMEs by governments have seen little success as these markets appeal only to a small group of firms. As of 2014, only four firms were listed in SME capital markets in the Philippines, 88 in India, 107 in Malaysia, and 111 in Thailand.

Funding for Women-led SMEs

In terms of gender, the SME finance gap for women is US$1.5T – with East Asia and Pacific and Sub-Saharan Africa contributing 59% (US$1.2T) and 17% (US$42B) of the gap attributed to women-led businesses. But there is overwhelming evidence for investing in women entrepreneurs that could lead to robust economic development and job creation. Findings from the Mastercard Index of Women Entrepreneurs (MIWE) 2017 study indicate that enabling conditions such as access to finance, ease of doing business and business support infrastructure help the progress of women-owned businesses. To tackle this deficit in capital, organizations around the world are deploying dedicated financing lines for women-led SMEs. This includes World Bank’s Women Entrepreneurs Finance Initiative (We-Fi) – a Financial Intermediary Fund (FIF) that will provide more than US$1B (combination of donor grants and commercial capital) in financing to break barriers in accessing finance, capacity building and networks. Other recent initiatives include YES Bank, Wells Fargo and OPIC’s partnership to provide US$50M of dedicated finance to women-led SMEs in India – an extension of their existing commitment to fund SMEs in the region.

Technology as an Enabler

Another key issue in SME lending is the difficulty in appraising the credit worthiness of SMEs due to information asymmetry – the absence of credit histories or lack of a digital documentation trail to evaluate growth trajectory of the businesses. SOCAP17 panelist Sam Parker pointed to the potential of technology to greatly reduce the cost of delivering financial services when he said, “Lean data is helping drive down costs. It isn’t sexy, but the impact is substantial.” But the question remains as to whether or not traditional financial institutions are capitalizing current technologies to bridge the SME financing gap.

Interest in tech-enabled lending is prevalent elsewhere – financial technology (fintech) firms and technology giants who are actively acquiring banking licenses to monetize their huge proprietary data on small businesses and consumers. In developing countries, Chinese tech companies such as Tencent Holdings and Alibaba have created their own online private banking arms – namely WeBank and MYBank which have extended more than 200B yuan of loans as of 2016. WeBank for instance has been able to increase its user base through its popular WeChat and QQ social media apps. Recently, Baidu too has launched aiBank (ai for Artificial Intelligence) – a joint venture between China Citic Bank and Baidu to offer deposits and loans to individuals and small businesses. These are still early days as Amazon and Paypal, who predominantly operate in the West and lend to their own users, are yet to make strides in lending in developing countries, where the need is the greatest.

Innovative Finance Solutions

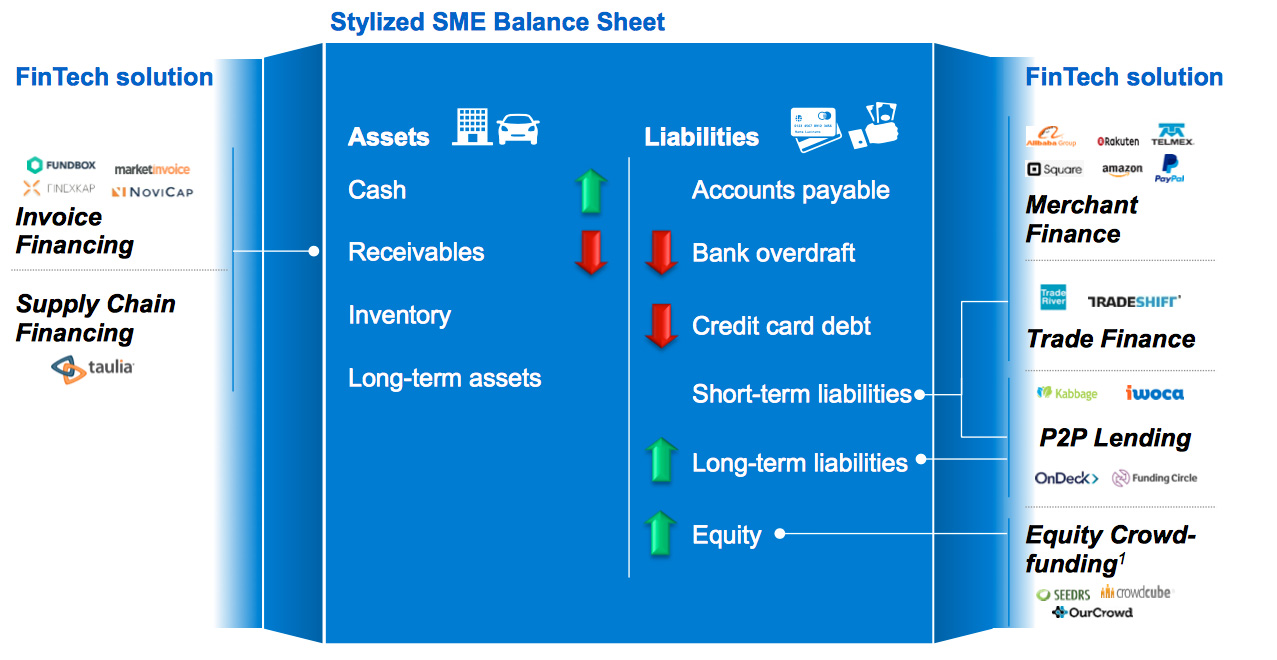

Fintech companies are introducing new innovations to address the funding gap such as invoice and supply chain financing, peer-to-peer lending, trade finance and equity crowdfunding. A report produced by Saïd Business School at the University of Oxford and the World Economic Forum’s Global Agenda Council recommends that for fintech to realize its potential, collaborative action of several parties is required. In India, the introduction of the new Goods and Services Tax is potentially helping introduce SMEs into the formal business ecosystem by creating mandatory digital trails. This growing trove of data could be leveraged by fintech companies to more accurately evaluate credit worthiness of the SMEs.

“As foundations and DFIs, our role is to experiment” commented panelist Philip Varnum of the Lemelson Foundation, whose work in India has been to create new pathways for capital. He shared that initiatives such as the Masala Bond, an offshore Indian rupee denominated bond first issued by IFC in 2015 providing single digit interest rates, could help deepen capital markets in developing countries. But these bond issuances have seen their share of criticism. Other notable mentions of innovative finance solutions included the “Variable Payment Obligation” (VPO) program by Enclude – a SME loan product for women entrepreneurs in Nicaragua, with cash-flow based lending methodology and repayment process.

When questioned on where the panel would like to see the SME financing market in five years, Sam Parker shared his aspiration of developing an impact monetization market, similar to the carbon credits market. Shalaka Joshi and Philip Varnum reiterated their desire of SME investing becoming the norm, whereas Marnix Mulder encouraged banks to finance mezzanine off-balance sheet.

Jayanth Kashyap B is an impact investing professional and recently graduated from the MBA at Saïd Business School (University of Oxford), where he was also a Director at the Oxford Seed Fund – a student-led technology VC.

Jayanth Kashyap B is an impact investing professional and recently graduated from the MBA at Saïd Business School (University of Oxford), where he was also a Director at the Oxford Seed Fund – a student-led technology VC.

Prior to the MBA, he was part of an India-focused seed impact fund at Ennovent and led the firm’s impact investment advisory projects across emerging markets. He is currently based out of London, UK and is active on LinkedIn, Twitter and Medium.