SOCAP24 Theme, Tracks and Content Curation Councils

Going Deeper: Catalyzing Systems Change

The challenges faced by the impact investment community are intricate and often rooted in systemic causes, demanding adaptive mentalities to address them. However, the implicit and sometimes explicit rules governing the establishment, management, and transactions of investment funds tend to favor simpler, more easily measurable solutions. This tendency is also evident in public narratives surrounding entrepreneurs’ journeys, pitch competitions, and attention-grabbing headlines.

The theme of SOCAP24, Going Deeper: Catalyzing Systems Change, encourages our community to critically examine our practices and challenge ourselves to delve deeper. Depth is our mandate for bringing about structural and irreversible change in the social, political, environmental, and economic systems from which the most pressing challenges emerge. As a community, SOCAP24 is poised to catalyze systemic change.

Recognizing that systematic shifts don’t result from a single action is essential. Instead, the most effective examples often arise from a combination of collective action, systemic acupuncture, breaking silos, evolving values, trust, and resources. Rather than focusing on isolated solutions, a systems change approach seeks to comprehend and influence a system’s underlying structures, relationships, and dynamics to create lasting, positive impact.

In a year like 2024, it is more critical than ever for our community to extend our gaze beyond our immediate spheres of influence and contribute to collective action, democratic dialogue, and policy leaps that can bring about impactful, scalable change.

Aligning with this year’s theme, we will question if capital truly fosters systemic change:

- Are we delving into underlying systemic issues, moving beyond surface-level solutions?

- Are we breaking silos collectively to address the root causes of global challenges?

- Are our partnerships dynamic and aligned for collaboration through complex issues?

- Do our impact investment approaches consider long-term perspectives?

- Fundamentally, whose voices are not being heard, and are those most impacted part of these systemic solutions?

Illustrating the pivotal role investors play in incentivizing impact, we aim beyond fixing what’s broken. We work towards averting future environmental crises and mitigating social unrest. These forward-looking approaches emphasize collaborative action, the creation of shared knowledge bases, the establishment of industry standards, and the generation of a rising tide of investment opportunities accessible to all.

We invite you to join us for SOCAP24 in San Francisco from October 28 to 30 — find the details and register here.

SOCAP24 Tracks

We take the content curation process seriously — it goes beyond selecting and organizing quality presenters and topics. We want our attendees to be a part of the session, a part of the takeaways that build a better future and help advance our community’s global mission. Within our theme, we have identified eight content tracks around which we will organize our sessions, each with global and regional perspectives interwoven throughout the conference. Each track and each session is the result of a months-long process designed to present a SOCAP24 experience that helps our community accelerate relationships, break down silos, and identify gaps — then bridge them.

How Is Content Curated for SOCAP24?

At SOCAP, content curation is a collaborative process that ensures a diverse and comprehensive program for our annual event. At SOCAP24, our content will be curated through three distinct sources, each contributing to one-third of the sessions.

The first third of our content comes from our Content Curation Councils, which are composed of experts in each of our focus tracks. These councils steer and guide the conversation, bringing their expertise to shape the content for SOCAP24.

Another third of our content is sourced from our trusted Content Partners, institutions that have long supported SOCAP’s community and mission. Working closely with our content team throughout the year, they bring highly curated sessions to the SOCAP stages.

Our SOCAP Open community contributes the final third of our content. This vibrant community of impact leaders submits session ideas that reflect the pulse of the global conversation around money and meaning.

This collaborative approach to content curation ensures that SOCAP offers a rich and diverse program that addresses the most pressing issues in the impact space.

Join us for SOCAP24 in San Francisco from October 28 to 30! Learn more and register here.

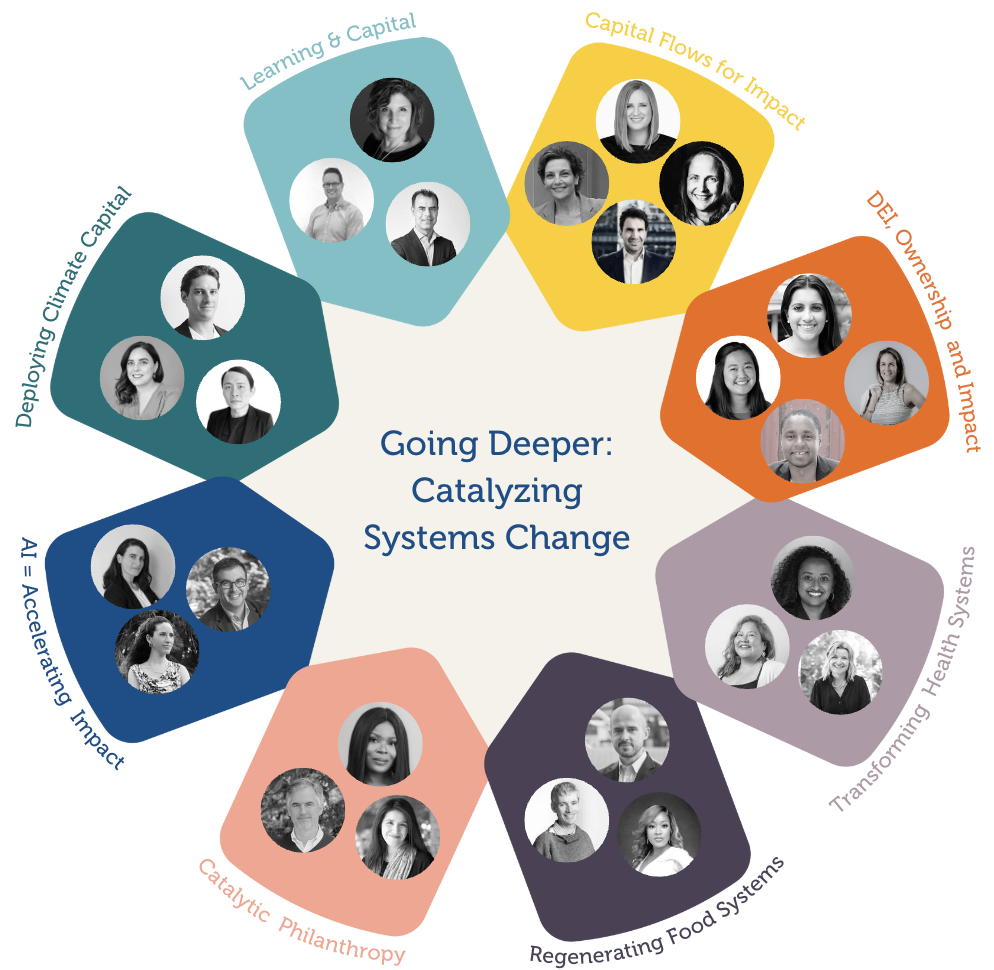

Content Curation Councils

We take the curation process seriously — it goes beyond selecting and organizing quality presenters and topics. We want our attendees to be a part of the session, a part of the takeaways that build a better future and help advance our community’s global mission.

Following the success of curation councils at SOCAP23, we are implementing them again in 2024 to maintain openness to the content curation process. Along with those selected through SOCAP Open, the sessions within each content track for SOCAP24 are co-created and curated by Content Curation Councils of 26 experts from around the world working closely with our content and production teams.

The Councils are tasked with identifying the set of sessions that will guide the conference conversations along each track.

Each track and each session is the result of a months-long process designed to present a SOCAP24 experience that helps our community accelerate relationships, break down silos, and identify gaps — then bridge them.