This article was originally posted by Alliance Bernstein, here.

Author: Dan Roarty

Tackling global poverty requires more than just charity. Investors can contribute to the effort—and find good sources of return potential—by focusing on companies that behave ethically or provide solutions to key poverty-related challenges.

Nearly 1 billion people have escaped poverty since the turn of the century. But the war on poverty is far from over—and the scale of the problem is enormous. We believe that securing future improvements will require bigger efforts from the private sector and investors, who can draw on The UN Sustainable Development Goals as a useful guide.

Extreme Poverty Has Fallen Sharply

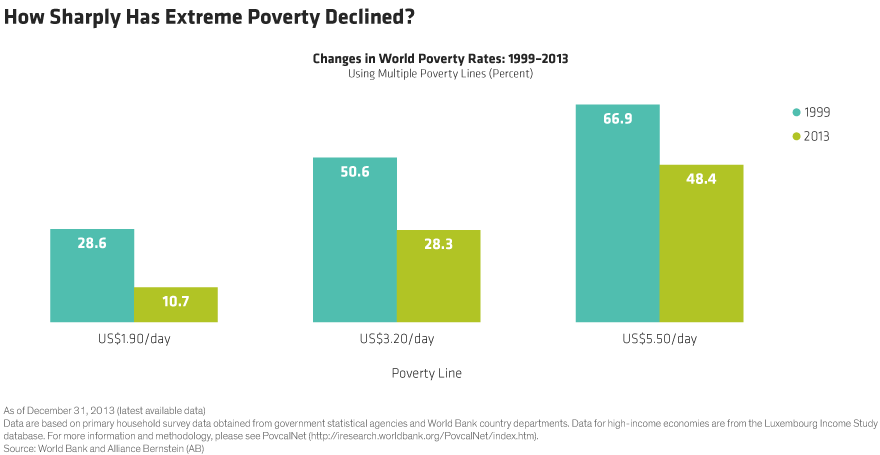

How is poverty measured? Typical statistics focus on the number of people falling below a level of income or consumption, such as the current international poverty line of US$1.90 per day. In 1999, there were 1.7 billion people—or 28.6% of the global population—living in such extreme poverty, according to The World Bank (Display). By 2013, those figures fell dramatically to 769 million and 10.7%, respectively, a reduction of about 1% per year. Many global leaders hope that rate of decline can continue, which would eliminate extreme poverty by 2030. However, we think some caution about the potential to completely eradicate poverty is warranted for several reasons.

Further Progress Will Be Challenging

First, a very small group of countries has driven virtually all the decline in global poverty this century. China alone accounted for half of the global reduction. Together with India, Indonesia and Vietnam, these four countries represent half the world’s population and were responsible for 83% of the decline in the global poverty rate. Collectively, these countries’ poverty rate fell from 41% in 1999 to just 9% in 2013. With extreme poverty nearly eradicated in these four countries, they won’t be able to contribute meaningfully to future global reductions.

Second, the remaining countries with the poorest populations have had far less success fighting poverty. In sub-Saharan Africa, for example, the extreme poverty rate has dropped since 1999, but still exceeds 40%. Many of these countries suffer from landlocked geographies, high rates of disaster and disease, bad governance, and conflict. These deep structural challenges make the “last mile” of poverty more difficult to conquer.

Statistics May Understate the Problem

Third, numbers don’t capture the true scope of global poverty. The $1.90 international poverty line is somewhat arbitrary. It represents the poverty line in the lowest-income countries like Afghanistan, Haiti and South Sudan. However, it can be easily argued that the poverty lines of lower-middle-income countries like India, Kenya and Pakistan (US$3.20/day) or upper-middle-income countries like Iran, Mexico and Thailand (US$5.50/day) are equally valid measures. Using those slightly higher poverty lines, the ranks of the global impoverished jump from 769 million people to either 2 billion people (28% of the global population) or 3.5 billion people (48%).

More broadly, we think poverty is not just about income levels. Even if a poor person’s income or consumption rises above the poverty line, they might still face malnutrition, lack of quality education and healthcare, and poor sanitation. The ranks of those suffering from multidimensional poverty deprivations dwarf those technically falling below the poverty lines.

What Can Investors Do?

By any measure, the global poverty dilemma is vast and complex. So the solutions to addressing it must be larger as well. We think both the private sector and equity investors have a crucial role to play.

Start by focusing on corporate behavior. Transnational corporations have enormous influence, accounting for as much as 80% of all global trade, according to UN data. The largest 1,000 firms collectively employ more than 70 million workers directly and impact hundreds of millions more through their global supply chains, based on an academic study by George Serafeim of the Harvard Business School. Funneling capital to companies with stronger environmental, social and governance (ESG) practices or encouraging those with weaker practices to improve can have meaningful societal impact.

In addition to providing attractive wages, corporations can help combat poverty by providing safe working conditions, educational opportunities and healthcare for employees. Investors benefit, too: a recent Bank of America Merrill Lynch study indicated that stocks with stronger ESG attributes have lower price, earnings and bankruptcy risk than weaker ESG companies.

Follow the UN’s Sustainable Development Goals

Investors can also target companies offering products and services that directly address key poverty-related challenges. The UN Sustainable Development Goals (SDGs) can be an effective strategy for identifying investment opportunities. These are 17 goals, co-created by 193 nations, that address the most critical areas of importance to humanity, including the multidimensional aspects of poverty.

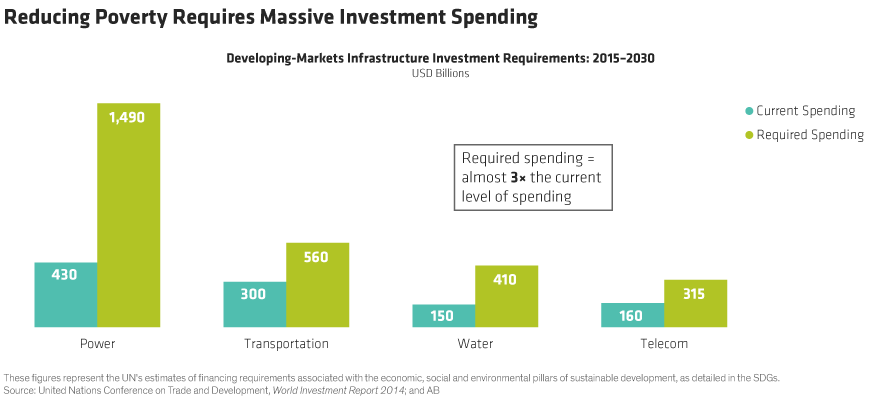

Fighting poverty requires substantial infrastructure investment. In fact, developing-market infrastructure accounts for almost half of all required global investment needs highlighted by the SDGs. Without modern energy, transportation, water, sanitation and telecommunications infrastructure, escaping the global poverty trap is all but impossible. A massive step up in spending is needed compared to today’s levels (Display)—and private investment is essential.

For example, a recent special report in The Economist stated that infrastructure investment is vital to enable technologies that can help poor African countries leap into the 21st century: “Much of the money going into African technology comes not from philanthropists but from hard-nosed investors looking for attractive returns.”

From Healthcare to Technology

Indeed, the SDGs go far beyond infrastructure. They highlight large opportunities in areas such as technology, healthcare and agriculture. They touch all economic sectors and all geographies and can form the backbone of a dynamic and thematic global equity strategy.

For investors, fighting poverty isn’t just about feeling good. In our view, it’s about helping to direct investment capital to places that really need it, which simply can’t be met by the public sector or NGOs. It’s also about conducting diligent company-specific research and management engagement to promote results. Thinking strategically about the challenges can help fight poverty and generate strong long-term investment returns while simultaneously delivering social dividends to some of the neediest corners of the planet.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.