We build our businesses to be valuable. We build them to increase in value for the founders, the investors, and maybe even to be worth something to the people the business serves and the community the business is supported by. And, generally, the way we assess that value is by how much financial capital we can attract and generate with that business.

The valuation of startups, in particular, can be frustratingly subjective and somewhat abstract, based on measurements like recurring revenue models, obtainable market value, liquidation analysis, and cashflow forecast. (It is also notoriously biased against women and people of color.)

Unfortunately, almost every common valuation method focuses on the financial capital, missing the opportunity for a full cost accounting of the complex and interdependent value of that organization.

Just like using only the Gross Domestic Product (GDP) to measure the wealth and health of nation is reductive and wrongheaded, measuring solely the financials of a company leads to a skewed and inaccurate valuation of any business. For instance, the 2010 BP oil spill, considered the worst oil spill in US history, resulted in the decimation of marine life in the Gulf and on the 125 miles of oil-soaked coastline. However, this environmental catastrophe contributed to a measurable rise in the United States’ GDP that year because of the huge expenditure on clean-up work in the Gulf of Mexico. Similarly, Uber came to be one of the highest fiscally valued private startups in the world, despite its value as a safe, egalitarian or enjoyable place to work being well-known for being exceptionally low.

“Not everything that can be counted counts. Not everything that counts can be counted.” ― William Bruce Cameron

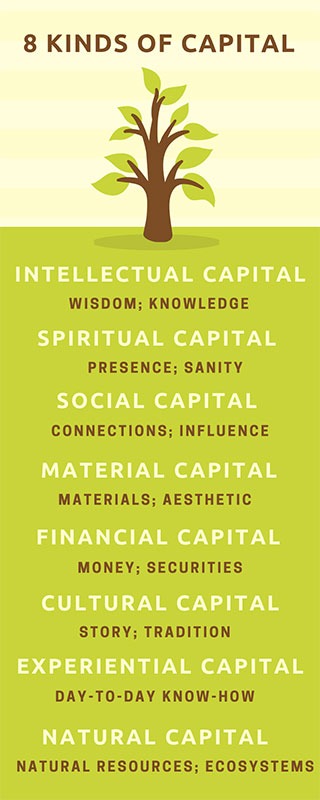

Turns out that financial capital is just one form of wealth worth measuring. Permaculture offers us some classifications for appreciating and evaluating several other forms of capital. Permaculture’s form of whole systems thinking, modeled on the patterns and the resilient features observed in natural ecosystems, provides us with a template for looking at integrated and adaptive wealth in its various forms. In their book, “Regenerative Enterprise,” Ethan Roland and Gregory Landua outlined 8 Forms of Capital: intellectual, spiritual, social, material, financial, living (or natural), cultural, and experiential (or human).

see other helpful diagrams here

see other helpful diagrams here

Building a business and sharing its value with investors clearly need not be limited by the narrow vertical of financial metrics. When opening your company to investors, consider expanding the type and spirit of investment possible for your company by including a broader picture of its capital in its valuation. In measuring and extending this value, here is a toolkit of questions for doing a more whole-systems accounting of that value.

Some questions for a intellectual capital evaluation:

- Does the company collect and manage data and metrics about itself?

- Does the company have access to information that supports smart decision-making?

- Are there rigorous methods for knowledge-building within the company?

- Does the company collaborate with other organizations to build knowledge?

- Does the company provide or have access to educational opportunities for its staff, employees, and leadership?

- How high is the quality of the information and data that the company uses and/or generates?

- How much intellectual property does the company contribute to a commons, such as an open-source community?

- Are there mentorship resources available to staff, employees and leadership through the company?

Intellectual capital resources:

- Permaculture principles, particularly applying permaculture design principles in business

- Sopact resources

- Open Source Initiative, Github and Open Source Guide

Some questions for a spiritual capital evaluation:

- Is the everyday work of the company’s staff, employees, and leadership connected to a larger, clearly understood mission?

- How much is self-care emphasized within the company?

- Are there any rituals or ceremonies practiced within the company that elevate the experience of the staff, employees, and leadership?

- Is there a culture of benevolence and kindness within the company?

- How much support is there for staff, employees, and leadership to practice meditation, yoga, or other mindfulness activities?

- How much is maintaining sanity emphasized in the operations of the company?

- Are there psychological and/or emotional-intelligence coaching resources available to staff, employees, and leadership through the company?

- Are there quiet spaces provided for staff, employees, and leadership to be to do work and non-work related activity or contemplation.

Spiritual capital resources:

Some questions for a social capital evaluation:

- Do staff, employees, and leadership have significant social and professional connections to other interesting groups and individuals?

- How well is conflict, internal, and external, processed within the company? What structures are in place to support those processes?

- What is the level of trust amongst staff, employees and leadership?

- What role does hospitality play in the company’s culture?

- How does the company support an environment of mutual aid?

- How much support does the company provide to staff, employees, and leadership to have a socially fulfilling experience at the company?

Social capital resources:

- Nan Lin’s Social Capital

- Social Capital Research articles

- Harvard Kennedy School Social Capital Toolkit

- Social Networks Toolkit

- Social & Human Capital Coalition

- Kapor Center research and resources — see the Tech Sector and Entrepreneur sections of the site

Some questions for a material capital evaluation:

- Are the facilities that house the company the right size? Do they have enough light, heat, air, and access to the outside?

- Are our facilities affordable and attractive?

- Are facilities and infrastructure run on renewable energy?

- Are the sourcing, production, shipping, and other elements of commerce reliant on renewable sources of energy?

- Are the facilities of the company safe and healthy places to work?

- In what ways are beauty and aesthetic value created and shared by the company?

Material capital resources:

- The Dirt

- American Society of Landscape Architects Resource Guides and Toolkits

- US Green Building Council LEED resources and articles

- Commons Magazine’s Toolbox for Introduction to the Commons

Some questions for a financial capital evaluation:

- How much revenue does the company generate?

- How much profit does the company generate?

- Does the company operate within its budget?

- How much of the company’s revenue stay within the local community?

- How much of the company’s profits go to people that work directly for the company?

- How stable is the currency that the company uses to operate?

- How financially stable are the company’s investments?

- How much of the financial capital generated by the company stays within the local community?

Financial capital resources:

- Sol Halpern / Mindful Finance blog

- Slow Money

- Capital Institute

- MIT’s Just Money course

Some questions for a living capital evaluation:

- How much do staff, employees and leadership spend time in nature?

- How clean is the water and air that the company uses?

- How much environmental damage is directly and indirectly caused by the company?

- How is the company measuring its environmental impact?

- How susceptible is the company to climate-change-related extreme weather events such as heat waves, drought, and flooding?

- How does the company support local food and ecosystems?

Living capital resources/experts:

Some questions for a cultural capital evaluation:

- Does the company have a clear and living mission?

- Within the company, is there a wealth of formal and informal traditions?

- How much cultural and ethnic diversity is contained and supported by the company?

- Do staff, employees, and leadership come from diverse backgrounds?

- Do staff, employees, and leadership feel comfortable expressing their culture background?

- Is the culture of the company in sync with its operations? Do the culture and operations of the company enhance each other, rather work against each other?

Cultural capital resources:

Some questions for a experiential capital evaluation:

- Does your company create opportunities for others to build on?

- How long does your company generally retain staff, employees, and leadership?

- Is there a core of long-time staff, employees, and leadership at the company?

- What are the structures in place to provide training to newer staff, employees, and leadership?

- Is there a diversity of skills and experiences represented among staff, employees, and leadership?

- Do staff, employees and leadership represent diverse life experiences?

- Are there career and leadership coaching resources available to staff, employees, and leadership through the company?

- How much of a safe and welcoming place is the company for people of differing experiences to work and be?

- In what ways is the company family-friendly and supportive of parents and caregivers?

Experiential capital resources:

- Adam Brock and Change Here Now

- CV Harquail — e.g. Three Design Principles for Generative Business

- Chade-Meng Tan

- B Corp resource library

- What does your cap table look like when it includes all eight forms of capital?

- Who is on your cap table when it includes all eight forms of capital? What are their investments?

- What feels most valuable about a company?

- What value does your company have to offer to its staff and employees?

- What value does your company have to offer to your community?

- What value does your company have to offer to creating environmental and/or social benefit?

- What do your employees and staff say is most valuable to them about working for your company?

- List the forms of capital that are used in solving the problem that your company is addressing.

- What makes up the value that users / customers / clients care about in your product or service?

- What kinds of capital does your company incorporate that are not included in the eight kinds of capital outlined here?

More and more entrepreneurs are rejecting venture capital and its prerogative to shape companies exclusively for a fast and lucrative exit. As they have historically been, and increasingly so, companies are benefiting from the value of being built on the capital inherent in diverse experience, community support, and dedication to a long-term, sustainable business model. Reframing capitalization from its narrow focus on traditional financing to a more comprehensive understanding of the various forms of capital creates opportunities that bypass many of the pitfalls of venture capital, and even conventional financing and investment. Each kind of capital affords unique opportunities — together they provide a resilient foundation for evaluating the worth of a company and a pragmatic reflection of its real value.

Special thanks to Adam Brock. Much of his elucidation of the eight forms of wealth in his chapter about Commoning in Change Here Now: Permaculture Solutions for Personal and Community Transformation was used here.

Corey Kohn is the CEO, co-founder and a member-owner of Dojo4, a community-based, member-owned agency that creates positive change through technology and design. She is also the co-creator of Antidote to Tech, a resource for technologists committed to thriving natural environments and genuine human connection.

Corey Kohn is the CEO, co-founder and a member-owner of Dojo4, a community-based, member-owned agency that creates positive change through technology and design. She is also the co-creator of Antidote to Tech, a resource for technologists committed to thriving natural environments and genuine human connection.