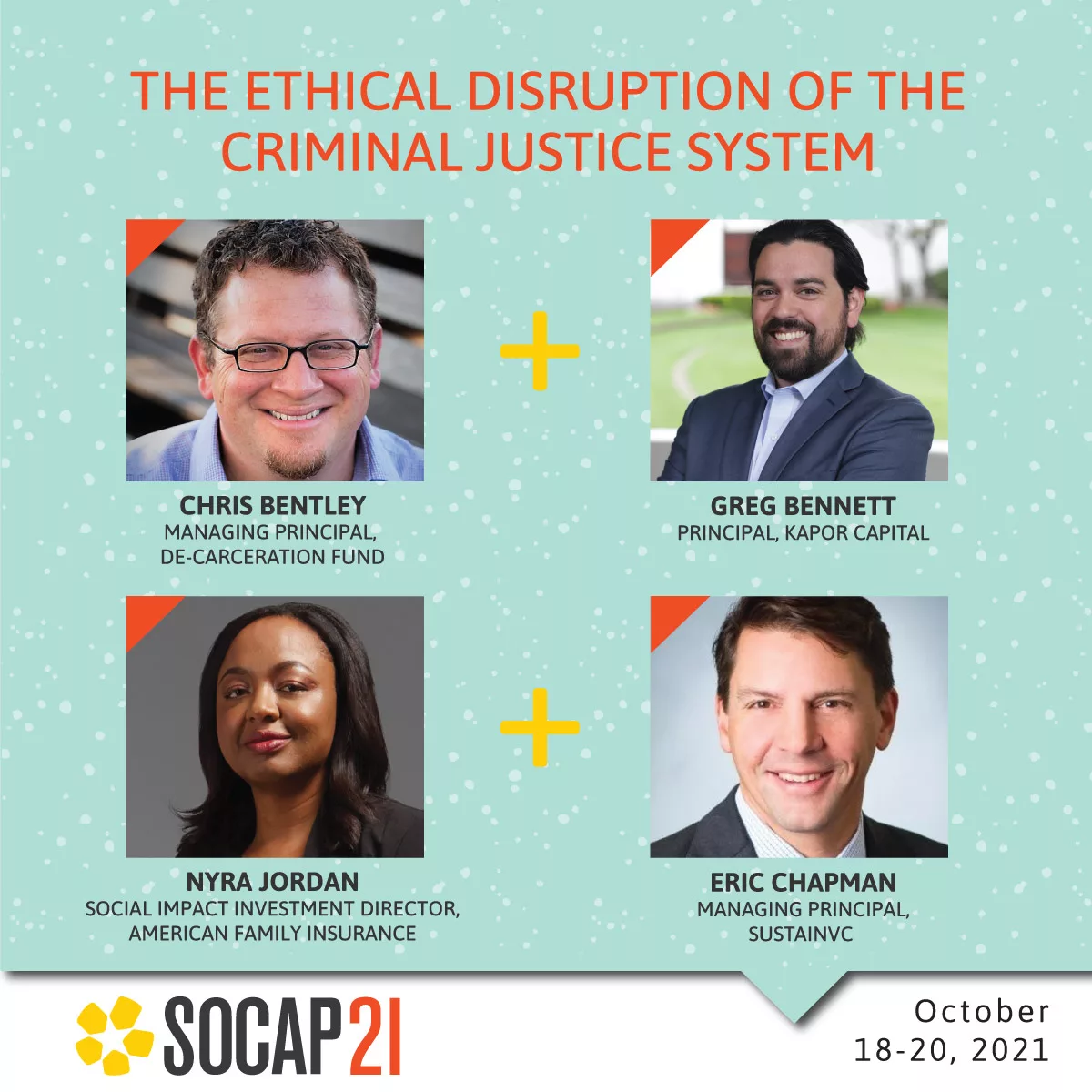

The U.S. criminal justice system directly impacts 6.6 million people at a direct public cost of more than $80 billion per year. This system is marred by racial disparities, extractive business practices, and misaligned incentives, but impact investors are finding ways to apply their capital through social justice investing. During this SOCAP21 session on The Ethical Disruption of the Criminal Justice System, leaders from four impact investment firms shared how they are supporting innovative social enterprises that are working to eliminate the suffering caused by the U.S. criminal justice system.

Chris Bentley, Managing Principal at the Decarceration Fund, said the fund is committed to non-extractive business models and aligned incentives that address the injustices of mass incarceration. “We invest in businesses that are returning power and agency to individuals who have had it systematically taken away,” he said. They include more than 2 million incarcerated individuals, more than 6 million people who are under supervision, and more than 10 million children who have one or more parents affected by incarceration. “It’s extremely wide-reaching with extremely painful outcomes associated with it,” Bentley said.

It’s vital to incorporate the voices and experiences of returning citizens into the discussions that shape these innovative social enterprise solutions, he said. “It is important for companies where possible to interface with nonprofits doing similar work and also learn from them. They can reveal a lot of what works and doesn’t work in this space.”

It’s also crucial to distinguish between market solutions and structural change that involves government or public policy, said Greg Bennett, Principal at Kapor Capital. “When you take well-intentioned capital to a market solution, things can change,” he said. “We do think it’s important for founders to have a real stake in the outcome if they’re correct and successful.”

Nyra Jordan, Social Impact Investment Director at the American Family Insurance Institute for Corporate and Social Impact, said the institute was launched in 2018 with a focus on economic empowerment and justice reform. “It’s about providing jobs but also supporting the startups ,” she said. “Our biggest challenge is to discern between ethical tech and tech that could exacerbate the disparities in the justice system. We want to be sure they’re disrupting in a way that is ethical, and bringing meaningful improvement to the lives of justice-involved individuals and their families.”

To drive learning and awareness of this opportunity, American Family Institute and Village Capital helped convene a summit in 2020 focused on redefining criminal and civil justice technology from an ethical, human-centered perspective, she said. They used learnings from the event, plus interviews and meetings, to produce a justice tech market assessment.

Eric Chapman, Managing Principal at SustainVC, said the firm also struggles with determining whether companies and their innovations will be ethical now and into the future. “There’s also the risk of unintended consequences with current or future management teams,” he said.

Because the criminal justice system is fragmented — with varying regulations and oversight at local, county, state, and federal levels — it involves a tremendous number of agencies and people. “We try to chip away at it from different angles,” Chapman said. “There’s not going to be an algorithm that suddenly comes in and makes sweeping change, but it can be chipped away at.”

Social Justice Investing: Watch The Ethical Disruption of the Criminal Justice System

Speakers:

Chris Bentley, Decarceration Fund

Nyra Jordan, American Family Insurance Institute for Corporate and Social Impact

Eric Chapman, SustainVC

Greg Bennett, Kapor Capital